Madden v. Midland Funding, LLC, 786 F.3d 246 (2d Cir. 2015), cert. denied, 136 S. Ct. 2505 (2016) (nonbank assignee not entitled to NBA preemption simply by virtue of the loan having been originated by a national bank.)

MUCH ADO ABOUT THE IMPACT OF MADDEN V MIDLAND

Why should Midland Funding LLC, a purchaser of charged-off debt be entitled to federal preemption benefits enjoyed by national banks when it is not chartered and subject to regulation as a national bank?

Much of the financial-industry criticism of the Second Circuit’s decision in Madden v. Midland Funding, LLC, 786 F.3d 246 (2d Cir. 2015) is conceptually flawed. A recent law review article titled “Madden V. Midland Funding LLC: Uprooting the National Bank Act’s Power of Preemption“ provides another example. It lumps distinct categories of secondary loan market participants together (“hedge funds, securitization vehicles, buyers of defaulted debt, purchasers of whole loans, and other purchasers of loans originated by national banks”) and fails to analyze the implications of the holding in Madden separately. As a result, it reaches far more sweeping and alarmist conclusions than are warranted.

|

| Andrew Silvia, Madden V. Midland Funding LLC: Uprooting the National Bank Act’s Power of Preemption, 92 Chi.-Kent. L. Rev. 653 (2017). Available at: http://scholarship.kentlaw.iit.edu/cklawreview/vol92/iss2/12 |

Midland Funding LLC and similar nonbank debt buyers acquire charged-off debt at pennies on the dollar and therefore do not provide a means for the originating bank to “liquify their debts” and make capital available for further lending. They merely mitigate the loss already sustained to a very slight degree. For that reason alone, any diminution of the resale value of the bad loans attributable to restrictions on the interest rate nonbank debt buyers of charged-off debt may legally charge cannot possibly have a substantial impact on the originating bank, its lending practices, or its financial performance. The analysis may be different in the securitization context, but that was not the scenario present in Madden.

Even if all existing and potentials purchasers of charged-off debt (Midland and its ilk) exited the market and even if the entire secondary market for charged-off consumer debt ceased to exist, the maximum incremental loss to the lenders (as owners of the charge-off debt) would be capped at the sale price (percent of nominal value) previously realized by lenders as seller of portfolios of charged-off accounts. And since all lenders entitled to the benefits of federal preemption would be affected equally, none would suffer a competitive disadvantage relative to the others from not being able to sell charged-off accounts at all, or having to sell them at an even greater discount: say 2.3% of nominal value, rather than 3.3%.

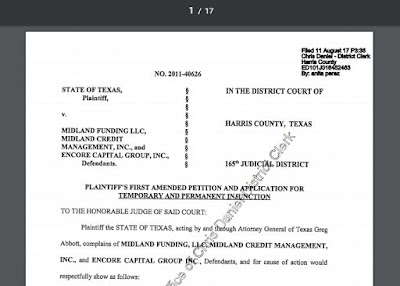

Midland Funding LLC routinely redacts the price paid for portfolios of charged-off accounts when it files copies of bills of sale in debt collection suits. In a 2013 state AG enforcement action against Midland for illegal debt collection practices, its servicer, and its parent company, the Texas Attorney General averred that the price Midland pays is 3.3% of the face value of the debt.

|

| Excerpt from State's Amended Original Petition in Cause No, 2011-40626 - STATE OF TEXAS (ACTING BY AND THROUGH ATTORNEY GEN vs. MIDLAND FUNDING LLC 165th District Court, Harris County, Texas |

Second, since the feared inability (or reduced ability) to sell charged-off debt to debt buyers would be systemic, the deterioration in loan/account resale proceeds could be compensated for by a higher interest rate at the front end that the original lenders could be able to implement without incurring a competitive disadvantage. Thanks to federal preemption, the lenders are permitted to legally charge their customers regardless of whether or not secondary market participants may or may not do so. And Madden does not change that.

Finally, even if nonbank debt buyers are not (or no longer) at liberty to exact the same (otherwise usurious) interest rates as national banks because they would incur state usury liability without the benefit of federal preemption under the NBA, the same would not be true of the federal banks as originators. Even if the U.S. Supreme Court were to embrace the holding in Madden v Midland and establish it as nationwide precedent, it would not subject national banks to state usury laws that they were previously exempt from. Nor does anyone force these lenders to make risky loans with higher incidence of subsequent delinquency and default. And the decision to sell such bad debt is the banks’ decision likewise. Banks have plenty of wiggle-room to adjust their business practices to changing regulatory realities.

And as for debt-buyers, they already have to adjust their collection activities state-by-state to comply with different statutes of limitations and differences in state-enacted fair debt collection laws, in addition to having to abide by state-specific licensing and bond requirements. Having to adjust claims of accrued interest above and beyond the charge-off balance acquired from the original creditor (or a prior assignee of the lender) to comply with state-specific interest rate limitations would not be all that different or particularly burdensome. The inability to add on as much interest as they would otherwise add if they were allowed to "inherit" preemption protection might marginally affect the price these debt buyers are willing to pay. But the proposition that they cease buying charge-off bank debt altogether is not plausible, especially when the collection of charged-off consumer debt is their sole line of business and the very reason for their existence.

MORE COMMENTARY OF THE DANGER-GLOOM-IF-NOT-DOOM

GENRE

GENRE

U.S. SUPREME COURT ORDERS IN MIDLAND VS. MADDEN

MIDLAND FUNDING, LLC, et al., petitioners,

v.

Saliha MADDEN.

Supreme Court of United States.

Petition for writ of certiorari to the United States Court of Appeals for the Second Circuit denied.

MIDLAND FUNDING, LLC, et al., petitioners,

v.

Saliha MADDEN.

Supreme Court of United States.

The Solicitor General is invited to file a brief in this case expressing the views of the United States.

SECOND CIRCUIT OPINION IN MADDEN V MIDLAND FUNDING LLC

Saliha MADDEN, on behalf of herself and all others similarly situated, Plaintiff-Appellant,

v.

MIDLAND FUNDING, LLC, Midland Credit Management, Inc., Defendants-Appellees.

United States Court of Appeals, Second Circuit.

247Daniel Adam Schlanger, Schlanger & Schlanger LLP, Pleasantville, N.Y. (Peter Thomas Lane, Schlanger & Schlanger LLP, Pleasantville, N.Y.; Owen Randolph Bragg, Horwitz, Horwitz & Associates, Chicago, IL, on the brief), for Saliha Madden.

Thomas Arthur Leghorn (Joseph L. Francoeur, on the brief), Wilson Elser Moskowitz Edelman & Dicker LLP, New York, N.Y., for Midland Funding, LLC and Midland Credit Management, Inc.

STRAUB, Circuit Judge:

This putative class action alleges violations of the Fair Debt Collection Practices Act ("FDCPA") and New York's usury law. The proposed class representative, Saliha Madden, alleges that the defendants violated the FDCPA by charging and attempting to collect interest at a rate higher than that permitted under the law of her home state, which is New York. The defendants contend that Madden's claims fail as a matter of law for two reasons: (1) state-law usury claims and FDCPA claims predicated on state-law violations against a national bank's assignees, such as the defendants here, are preempted by the National Bank Act ("NBA"), and (2) the agreement governing Madden's debt requires the application of Delaware law, under which the interest charged is permissible.

The District Court entered judgment for the defendants. Because neither defendant is a national bank nor a subsidiary or agent of a national bank, or is otherwise acting on behalf of a national bank, and because application of the state law on which Madden's claims rely would not significantly interfere with any national bank's ability to exercise its powers under the NBA, we reverse the District Court's holding that the NBA preempts Madden's claims and accordingly vacate the judgment of the District Court. We leave to the District Court to address in the first instance whether the Delaware choice-of-law clause precludes Madden's claims.

The District Court also denied Madden's motion for class certification, holding that potential NBA preemption required individualized factual inquiries incompatible with proceeding as a class. Because this conclusion rested upon the same erroneous preemption analysis, we also vacate the District Court's denial of class certification.

BACKGROUND

A. Madden's Credit Card Debt, the Sale of Her Account, and the Defendants' Collection Efforts

In 2005, Saliha Madden, a resident of New York, opened a Bank of America ("BoA") credit card account. BoA is a national bank.[1] The account was governed 248*248 by a document she received from BoA titled "Cardholder Agreement." The following year, BoA's credit card program was consolidated into another national bank, FIA Card Services, N.A. ("FIA"). Contemporaneously with the transfer to FIA, the account's terms and conditions were amended upon receipt by Madden of a document titled "Change In Terms," which contained a Delaware choice-of-law clause.

Madden owed approximately $5,000 on her credit card account and in 2008, FIA "charged-off" her account (i.e., wrote off her debt as uncollectable). FIA then sold Madden's debt to Defendant-Appellee Midland Funding, LLC ("Midland Funding"), a debt purchaser. Midland Credit Management, Inc. ("Midland Credit"), the other defendant in this case, is an affiliate of Midland Funding that services Midland Funding's consumer debt accounts. Neither defendant is a national bank. Upon Midland Funding's acquisition of Madden's debt, neither FIA nor BoA possessed any further interest in the account.

In November 2010, Midland Credit sent Madden a letter seeking to collect payment on her debt and stating that an interest rate of 27% per year applied.

B. Procedural History

A year later, Madden filed suit against the defendants—on behalf of herself and a putative class—alleging that they had engaged in abusive and unfair debt collection practices in violation of the FDCPA, 15 U.S.C. §§ 1692e, 1692f, and had charged a usurious rate of interest in violation of New York law, N.Y. Gen. Bus. Law § 349; N.Y. Gen. Oblig. Law § 5-501; N.Y. Penal Law § 190.40 (proscribing interest from being charged at a rate exceeding 25% per year).

On September 30, 2013, the District Court denied the defendants' motion for summary judgment and Madden's motion for class certification. In ruling on the motion for summary judgment, the District Court concluded that genuine issues of material fact remained as to whether Madden had received the Cardholder Agreement and Change In Terms, and as to whether FIA had actually assigned her debt to Midland Funding. However, the court stated that if, at trial, the defendants were able to prove that Madden had received the Cardholder Agreement and Change In Terms, and that FIA had assigned her debt to Midland Funding, her claims would fail as a matter of law because the NBA would preempt any state-law usury claim against the defendants. The District Court also found that if the Cardholder Agreement and Change In Terms were binding upon Madden, any FDCPA claim of false representation or unfair practice would be defeated because the agreement permitted the interest rate applied by the defendants.

In ruling on Madden's motion for class certification, the District Court held that because "assignees are entitled to the protection of the NBA if the originating bank was entitled to the protection of the NBA... the class action device in my view is not appropriate here." App'x at 120. The District Court concluded that the proposed class failed to satisfy Rule 23(a)'s commonality and typicality requirements because "[t]he claims of each member of the class will turn on whether the class member agreed to Delaware interest rates" and "whether the class member's debt was validly assigned to the Defendants," id. at 249*249 127-28, both of which were disputed with respect to Madden. Similarly, the court held that the requirements of Rule 23(b)(2) (relief sought appropriate to class as a whole) and (b)(3) (common questions of law or fact predominate) were not satisfied "because there is no showing that the circumstances of each proposed class member are like those of Plaintiff, and because the resolution will turn on individual determinations as to cardholder agreements and assignments of debt." Id. at 128.

On May 30, 2014, the parties entered into a "Stipulation for Entry of Judgment for Defendants for Purpose of Appeal." Id. at 135. The parties stipulated that FIA had assigned Madden's account to the defendants and that Madden had received the Cardholder Agreement and Change In Terms. This stipulation disposed of the two genuine disputes of material fact identified by the District Court, and provided that "a final, appealable judgment in favor of Defendants is appropriate." Id. at 138. The District Court "so ordered" the Stipulation for Entry of Judgment.

This timely appeal followed.

DISCUSSION

Madden argues on appeal that the District Court erred in holding that NBA preemption bars her state-law usury claims. We agree. Because neither defendant is a national bank nor a subsidiary or agent of a national bank, or is otherwise acting on behalf of a national bank, and because application of the state law on which Madden's claims rely would not significantly interfere with any national bank's ability to exercise its powers under the NBA, we reverse the District Court's holding that the NBA preempts Madden's claims and accordingly vacate the judgment of the District Court. We also vacate the District Court's judgment as to Madden's FDCPA claim and the denial of class certification because those rulings were predicated on the same flawed preemption analysis.

The defendants contend that even if we find that Madden's claims are not preempted by the NBA, we must affirm because Delaware law—rather than New York law—applies and the interest charged by the defendants is permissible under Delaware law. Because the District Court did not reach this issue, we leave it to the District Court to address in the first instance on remand.

I. National Bank Act Preemption

The federal preemption doctrine derives from the Supremacy Clause of the United States Constitution, which provides that "the Laws of the United States which shall be made in Pursuance" of the Constitution "shall be the supreme Law of the Land." U.S. Const. art. VI, cl. 2. According to the Supreme Court, "[t]he phrase `Laws of the United States' encompasses both federal statutes themselves and federal regulations that are properly adopted in accordance with statutory authorization." City of New York v. FCC,486 U.S. 57, 63, 108 S.Ct. 1637, 100 L.Ed.2d 48 (1988).

"Preemption can generally occur in three ways: where Congress has expressly preempted state law, where Congress has legislated so comprehensively that federal law occupies an entire field of regulation and leaves no room for state law, or where federal law conflicts with state law." Wachovia Bank, N.A. v. Burke, 414 F.3d 305, 313 (2d Cir.2005), cert. denied, 550 U.S. 913, 127 S.Ct. 2093, 167 L.Ed.2d 830 (2007). The defendants appear to suggest that this case involves "conflict preemption," which "occurs when compliance with both state and federal law is impossible, or when the state law stands as an obstacle to the accomplishment and execution of the 250*250 full purposes and objective of Congress." United States v. Locke, 529 U.S. 89, 109, 120 S.Ct. 1135, 146 L.Ed.2d 69 (2000) (internal quotation marks omitted).

The National Bank Act expressly permits national banks to "charge on any loan ... interest at the rate allowed by the laws of the State, Territory, or District where the bank is located." 12 U.S.C. § 85. It also "provide[s] the exclusive cause of action" for usury claims against national banks, Beneficial Nat'l Bank v. Anderson, 539 U.S. 1, 11, 123 S.Ct. 2058, 156 L.Ed.2d 1 (2003), and "therefore completely preempt[s] analogous state-law usury claims," Sullivan v. Am. Airlines, Inc., 424 F.3d 267, 275 (2d Cir.2005). Thus, there is "no such thing as a state-law claim of usury against a national bank." Beneficial Nat'l Bank, 539 U.S. at 11, 123 S.Ct. 2058; see also Pac. Capital Bank, N.A. v. Connecticut, 542 F.3d 341, 352 (2d Cir.2008) ("[A] state in which a national bank makes a loan may not permissibly require the bank to charge an interest rate lower than that allowed by its home state."). Accordingly, because FIA is incorporated in Delaware, which permits banks to charge interest rates that would be usurious under New York law, FIA's collection at those rates in New York does not violate the NBA and is not subject to New York's stricter usury laws, which the NBA preempts.

The defendants argue that, as assignees of a national bank, they too are allowed under the NBA to charge interest at the rate permitted by the state where the assignor national bank is located—here, Delaware. We disagree. In certain circumstances, NBA preemption can be extended to non-national bank entities. To apply NBA preemption to an action taken by a non-national bank entity, application of state law to that action must significantly interfere with a national bank's ability to exercise its power under the NBA. See Barnett Bank of Marion Cnty., N.A. v. Nelson, 517 U.S. 25, 33, 116 S.Ct. 1103, 134 L.Ed.2d 237 (1996); Pac. Capital Bank, 542 F.3d at 353.

The Supreme Court has suggested that that NBA preemption may extend to entities beyond a national bank itself, such as non-national banks acting as the "equivalent to national banks with respect to powers exercised under federal law." Watters v. Wachovia Bank, N.A., 550 U.S. 1, 18, 127 S.Ct. 1559, 167 L.Ed.2d 389 (2007). For example, the Supreme Court has held that operating subsidiaries of national banks may benefit from NBA preemption. Id.; see also Burke, 414 F.3d at 309 (deferring to reasonable regulation that operating subsidiaries of national banks receive the same preemptive benefit as the parent bank). This Court has also held that agents of national banks can benefit from NBA preemption. Pac. Capital Bank, 542 F.3d at 353-54 (holding that a third-party tax preparer who facilitated the processing of refund anticipation loans for a national bank was not subject to Connecticut law regulating such loans); see also SPGGC, LLC v. Ayotte, 488 F.3d 525, 532 (1st Cir.2007) ("The National Bank Act explicitly states that a national bank may use `duly authorized officers or agents' to exercise its incidental powers." (internal citation omitted)), cert. denied, 552 U.S. 1185, 128 S.Ct. 1258, 170 L.Ed.2d 68 (2008).

The Office of the Comptroller of the Currency ("OCC"), "a federal agency that charters, regulates, and supervises all national banks," Town of Babylon v. Fed. Hous. Fin. Agency, 699 F.3d 221, 224 n. 2 (2d Cir.2012), has made clear that third-party debt buyers are distinct from agents or subsidiaries of a national bank, see OCC Bulletin 2014-37, Risk Management Guidance (Aug. 4, 2014), available at http:// www.occ.gov/news-issuances/bulletins/ 251*251 2014/bulletin-2014-37.html ("Banks may pursue collection of delinquent accounts by (1) handling the collections internally, (2) using third parties as agents in collecting the debt, or (3) selling the debt to debt buyers for a fee."). In fact, it is precisely because national banks do not exercise control over third-party debt buyers that the OCC issued guidance regarding how national banks should manage the risk associated with selling consumer debt to third parties. See id.

In most cases in which NBA preemption has been applied to a non-national bank entity, the entity has exercised the powers of a national bank—i.e., has acted on behalf of a national bank in carrying out the national bank's business. This is not the case here. The defendants did not act on behalf of BoA or FIA in attempting to collect on Madden's debt. The defendants acted solely on their own behalves, as the owners of the debt.

No other mechanism appears on these facts by which applying state usury laws to the third-party debt buyers would significantly interfere with either national bank's ability to exercise its powers under the NBA. See Barnett Bank, 517 U.S. at 33, 116 S.Ct. 1103. Rather, such application would "limit[] only activities of the third party which are otherwise subject to state control," SPGGC, LLC v. Blumenthal, 505 F.3d 183, 191 (2d Cir.2007), and which are not protected by federal banking law or subject to OCC oversight.

We reached a similar conclusion in Blumenthal. There, a shopping mall operator, SPGGC, sold prepaid gift cards at its malls, including its malls in Connecticut. Id. at 186. Bank of America issued the cards, which looked like credit or debit cards and operated on the Visa debit card system. Id. at 186-87. The gift cards included a monthly service fee and carried a one-year expiration date. Id. at 187. The Connecticut Attorney General sued SPGGC alleging violations of Connecticut's gift card law, which prohibits the sale of gift cards subject to inactivity or dormancy fees or expiration dates. Id. at 187-88. SPGGC argued that NBA preemption precluded suit. Id. at 189.

We held that SPGGC failed to state a valid claim for preemption of Connecticut law insofar as the law prohibited SPGGC from imposing inactivity fees on consumers of its gift cards. Id. at 191. We reasoned that enforcement of the state law "does not interfere with BoA's ability to exercise its powers under the NBA and OCC regulations." Id."Rather, it affects only the conduct of SPGGC, which is neither protected under federal law nor subject to the OCC's exclusive oversight." Id.

We did find, in Blumenthal, that Connecticut's prohibition on expiration dates could interfere with national bank powers because Visa requires such cards to have expiration dates and "an outright prohibition on expiration dates could have prevented a Visa member bank (such as BoA) from acting as the issuer of the Simon Giftcard." Id. at 191. We remanded for further consideration of the issue. Here, however, state usury laws would not prevent consumer debt sales by national banks to third parties. Although it is possible that usury laws might decrease the amount a national bank could charge for its consumer debt in certain states (i.e., those with firm usury limits, like New York), such an effect would not "significantly interfere" with the exercise of a national bank power.

Furthermore, extension of NBA preemption to third-party debt collectors such as the defendants would be an overly broad application of the NBA. Although national banks' agents and subsidiaries exercise national banks' powers and receive protection under the NBA when doing so, 252*252 extending those protections to third parties would create an end-run around usury laws for non-national bank entities that are not acting on behalf of a national bank.

The defendants and the District Court rely principally on two Eighth Circuit cases in which the court held that NBA preemption precluded state-law usury claims against non-national bank entities. In Krispin v. May Department Stores, 218 F.3d 919 (8th Cir.2000),May Department Stores Company ("May Stores"), a non-national bank entity, issued credit cards to the plaintiffs. Id. at 921. By agreement, those credit card accounts were governed by Missouri law, which limits delinquency fees to $10. Id. Subsequently, May Stores notified the plaintiffs that the accounts had been assigned and transferred to May National Bank of Arizona ("May Bank"), a national bank and wholly-owned subsidiary of May Stores, and that May Bank would charge delinquency fees of up to "$15, or as allowed by law." Id. Although May Stores had transferred all authority over the terms and operations of the accounts to May Bank, it subsequently purchased May Bank's receivables and maintained a role in account collection. Id. at 923.

The plaintiffs brought suit under Missouri law against May Stores after being charged $15 delinquency fees. Id. at 922. May Stores argued that the plaintiffs' state-law claims were preempted by the NBA because the assignment and transfer of the accounts to May Bank "was fully effective to cause the bank, and not the store, to be the originator of [the plaintiffs'] accounts subsequent to that time." Id. at 923. The court agreed:

[T]he store's purchase of the bank's receivables does not diminish the fact that it is now the bank, and not the store, that issues credit, processes and services customer accounts, and sets such terms as interest and late fees. Thus, although we recognize that the NBA governs only national banks, in these circumstances we agree with the district court that it makes sense to look to the originating entity (the bank), and not the ongoing assignee (the store), in determining whether the NBA applies.

Id. at 924 (internal citation omitted).[2]

Krispin does not support finding preemption here. In Krispin, when the national bank's receivables were purchased by May Stores, the national bank retained ownership of the accounts, leading the court to conclude that "the real party in interest is the bank." Id.Unlike Krispin, neither BoA nor FIA has retained an interest in Madden's account, which further supports the conclusion that subjecting the defendants to state regulations 253*253does not prevent or significantly interfere with the exercise of BoA's or FIA's powers.

The defendants and the District Court also rely upon Phipps v. FDIC, 417 F.3d 1006 (8th Cir.2005). In that case, the plaintiffs brought an action under Missouri law to recover allegedly unlawful fees charged by a national bank on mortgage loans. The plaintiffs alleged that after charging these fees, which included a purported "finder's fee" to third-party Equity Guaranty LLC (a non-bank entity), the bank sold the loans to other defendants. The court held that the fees at issue were properly considered "interest" under the NBA and concluded that, under those circumstances, it "must look at `the originating entity (the bank), and not the ongoing assignee ... in determining whether the NBA applies.'" Id. at 1013 (quoting Krispin, 218 F.3d at 924 (alteration in original)).

Phipps is distinguishable from this case. There, the national bank was the entity that charged the interest to which the plaintiffs objected. Here, on the other hand, Madden objects only to the interest charged after her account was sold by FIA to the defendants. Furthermore, if Equity Guaranty was paid a "finder's fee," it would benefit from NBA preemption as an agent of the national bank. Indeed, Phipps recognized that "`[a] national bank may use the services of, and compensate persons not employed by, the bank for originating loans.'" Id. (quoting 12 C.F.R. § 7.1004(a)). Here, the defendants do not suggest that they have such a relationship with BoA or FIA.[3]

II. Choice of Law: Delaware vs. New York

The defendants contend that the Delaware choice-of-law provision contained in the Change In Terms precludes Madden's New York usury claims.[4] Although raised below, the District Court did not reach this issue in ruling on the defendants' motion for summary judgment.[5] Subsequently, in the Stipulation for Entry of Judgment, the parties resolved in the defendants' favor the dispute as to whether Madden was bound by the Change In Terms. The parties appear to agree that if Delaware law applies, the rate the defendants charged Madden was permissible.[6]

254*254 We do not decide the choice-of-law issue here, but instead leave it for the District Court to address in the first instance.[7]

III. Madden's Fair Debt Collection Practices Act Claim

Madden also contends that by attempting to collect interest at a rate higher than allowed by New York law, the defendants falsely represented the amount to which they were legally entitled in violation of the FDCPA, 15 U.S.C. §§ 1692e(2)(A), (5), (10), 1692f(1). The District Court denied the defendants' motion for summary judgment on this claim for two reasons. First, it held that there was a genuine dispute of material fact as to whether the defendants are assignees of FIA; if they are, it reasoned, Madden's FDCPA claim would fail because state usury laws—the alleged violation of which provide the basis for Madden's FDCPA claim—do not apply to assignees of a national bank. The parties subsequently stipulated "that FIA assigned Defendants Ms. Madden's account," App'x at 138, and the District Court, in accord with its prior ruling, entered judgment for the defendants. Because this analysis was predicated on the District Court's erroneous holding that the defendants receive the same protections under the NBA as do national banks, we find that it is equally flawed.

Second, the District Court held that if Madden received the Cardholder Agreement and Change In Terms, a fact to which the parties later stipulated, any FDCPA claim of false representation or unfair practice would fail because the agreement allowed for the interest rate applied by the defendants. This conclusion is premised on an assumption that Delaware law, rather than New York law, applies, an issue the District Court did not reach. If New York's usury law applies notwithstanding the Delaware choice-of-law clause, the defendants may have made a false representation or engaged in an unfair practice insofar as their collection letter to Madden stated that they were legally entitled to charge interest in excess of that permitted by New York law. Thus, the District Court may need to revisit this conclusion after deciding whether Delaware or New York law applies.

Because the District Court's analysis of the FDCPA claim was based on an erroneous NBA preemption finding and a premature assumption that Delaware law applies, we vacate the District Court's judgment as to this claim.

IV. Class Certification

Madden asserts her claims on behalf of herself and a class consisting of "all persons residing in New York [] who were sent a letter by Defendants attempting to collect interest in excess of 25% per annum [] regarding debts incurred for personal, family, or household purposes." Pl.'s Class Certification Mem. 1, No. 7:11-cv-08149 (S.D.N.Y. Jan. 18, 2013), ECF No. 29. The defendants have represented that they sent such letters with respect to 49,780 accounts.

255*255 Madden moved for class certification before the District Court. The District Court denied the motion, holding that because "assignees are entitled to the protection of the NBA if the originating bank was entitled to the protection of the NBA... the class action device in my view is not appropriate here." App'x at 120. Because the District Court's denial of class certification was entwined with its erroneous holding that the defendants receive the same protections under the NBA as do national banks, we vacate the denial of class certification.

CONCLUSION

We REVERSE the District Court's holding as to National Bank Act preemption, VACATE the District Court's judgment and denial of class certification, and REMAND for further proceedings consistent with this opinion.

[1] National banks are "corporate entities chartered not by any State, but by the Comptroller of the Currency of the U.S. Treasury." Wachovia Bank v. Schmidt, 546 U.S. 303, 306, 126 S.Ct. 941, 163 L.Ed.2d 797 (2006).

[2] We believe the District Court gave unwarranted significance to Krispin's reference to the "originating entity" in the passage quoted above. The District Court read the sentence to suggest that, once a national bank has originated a credit, the NBA and the associated rule of conflict preemption continue to apply to the credit, even if the bank has sold the credit and retains no further interest in it. The point of the Krispin holding was, however, that notwithstanding the bank's sale of its receivables to May Stores, it retained substantial interests in the credit card accounts so that application of state law to those accounts would have conflicted with the bank's powers authorized by the NBA. The crucial words of the sentence were "in these circumstances," which referred to the fact stated in the previous sentence of the bank's retention of substantial interests in the credit card accounts. As we understand the Krispin opinion, the fact that the bank was described as the "originating entity" had no significance for the court's decision, which would have come out the opposite way if the bank, notwithstanding that it originated the credits in question, had sold them outright to a new, unrelated owner, divesting itself completely of any continuing interest in them, so that its operations would no longer be affected by the application of state law to the new owner's further administration of the credits.

[3] We are not persuaded by Munoz v. Pipestone Financial, LLC, 513 F.Supp.2d 1076 (D.Minn. 2007), upon which the defendants and the District Court also rely. Although the court found preemption applicable to an assignee of a national bank in a case analogous to Madden's suit, it misapplied Eighth Circuit precedent by applying unwarranted significance to Krispin's use of the word "originating entity" and straying from the essential inquiry—whether applying state law would "significantly interfere with the national bank's exercise of its powers," Barnett Bank, 517 U.S. at 33, 116 S.Ct. 1103, because of a subsidiary or agency relationship or for other reasons.

[4] The Change In Terms, which amended the original Cardholder Agreement, includes the following provision: "This Agreement is governed by the laws of the State of Delaware (without regard to its conflict of laws principles) and by any applicable federal laws." App'x at 58, 91.

[5] We reject Madden's contention that this argument was waived. First, although the defendants' motion for summary judgment urged the District Court to rule on other grounds, it did raise the Delaware choice-of-law clause. Defs.' Summ. J. Mem. 4 & n. 3, No. 7:11-cv-08149 (S.D.N.Y. Jan. 25, 2013), ECF No. 32. Second, this argument was not viable prior to the Stipulation for Entry of Judgment due to unresolved factual issues—principally, whether Madden had received the Change In Terms.

[6] We express no opinion as to whether Delaware law, which permits a "bank" to charge any interest rate allowable by contract, see Del. Code Ann. tit. 5, § 943, would apply to the defendants, both of which are non-bank entities.

[7] Because it may assist the District Court, we note that there appears to be a split in the case law. Compare Am. Equities Grp., Inc. v. Ahava Dairy Prods. Corp., No. 01 Civ. 5207(RWS), 2004 WL 870260, at *7-9 (S.D.N.Y. Apr. 23, 2004) (applying New York's usury law despite out-of-state choice-of-law clause); Am. Express Travel Related Servs. Co. v. Assih, 26 Misc.3d 1016, 1026, 893 N.Y.S.2d 438 (N.Y.Civ.Ct.2009) (same); N. Am. Bank, Ltd. v. Schulman, 123 Misc.2d 516, 520-21, 474 N.Y.S.2d 383 (N.Y.Cnty.Ct.1984) (same) with RMP Capital Corp. v. Bam Brokerage, Inc., 21 F.Supp.3d 173, 186 (E.D.N.Y.2014) (finding out-of-state choice-of-law clause to preclude application of New York's usury law).

No comments:

Post a Comment