This blog covers debt collection litigation and practices, and related legal, procedural, and public policy issues, from the perspective of consumers.

Friday, November 29, 2013

Do debt collection attorneys have to comply with the FDCPA? Are they covered?

FDCPA When do attorneys face liability under the federal Fair Debt Collection Practices Act?

Can collection attorneys be sued under the FDCPA if they engage in deceptive or otherwise prohibited conduct?

In principle, yes, but not always. The debt at issue must be a consumer debt and the attorney must meet the definition of debt collector that is set forth in the act. A single debt collection suit would not make the filing attorney a debt collector (under the FDCPA) because the statute says that it applies only to those who engage in debt collection on a regular basis.

WHO IS A DEBT COLLECTOR UNDER THE FDCPA? and WHEN DOES THIS APPLY TO COLLECTION ATTORNEYS?

Attorneys qualify as debt collectors for purposes of the FDCPA when they regularly engage in consumer debt collection, such as litigation on behalf of a creditor client that is a national bank or other financial institution, or an assignee of an original creditor.

Numbers matter

A person may “regularly” collect debts even if debt collection is not the principal purpose of his business. If the volume of a person’s debt collection services is great enough, it is irrelevant that these services only amount to a small fraction of his total business activity. Whether a party "regularly" attempts to collect debts is determined, of course, by the volume or frequency of its debt-collection activities.

What is 'regular'?

But there is no clear-cut rule or yardstick that can be used to determine what amounts to regular, so the status issue may have to be litigated in the particular case, unless the attorney's correspondence expressly states that the attorney is a debt collector on its paperwork (correspondence and pleadings) or concedes the issue in the course of an FDCPA action. In a complaint filed in federal court, specific allegations must be set forth in the initial pleading, including those pertinent to the essential elements of a cause of action, and the defendant must admit or deny each allegation in his answer.

Status definition not vague

At some point the definition of “debt collector” in 15 U.S.C. § 1692a(6) was challenged as unconstitutionally vague, but the Fifth Circuit Court of Appeals decided that it was not, pointing out that it was a statute that regulates economic activty and provides for civil penalties rather than jail, and that courts have managed with the statutory definition for a long time since FDCPA was enacted with no major problems in making the necessary determinations as to debt collector status under the Act on a case-by-case basis.

When the federal act is not available

Note that the FDCPA has a state law counterpart, the Texas Debt Collection Add (TDCA). The TDCA (also abbreviated DCA with the T for Texas omitted) uses a different definition of those covered by it, which includes original creditors, and differs in other significant respects. -- > Suing under the Texas Debt Collection Act.

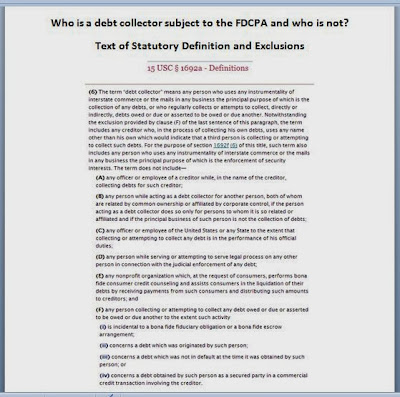

STATUTORY DEFINITION OF DEBT COLLECTOR UNDER FDCPA

LEADING CASE FOR LAWYERS AS FDCPA DEFENDANTS

Heintz v. Jenkins, 514 U.S. 291, 292 (1995) (litigating lawyers are not exempt from the FDCPA if they otherwise qualify as debt collectors)

RELATED FAIR DEBT COLLECTION TOPICS

Consumer's counterclaim under federal and state fair debt collection laws

Federal vs state regulation of debt collectors: FDCPA and Texas Debt Collection Act

Differences between FDCPA and TDCA: Who is covered, what type of debt, and what conduct provides grounds for relief?

What is a consumer debt under federal fair debt collection practices law?

Mandatory venue violations: Consumer sued in the wrong county and wrong court

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment