Enforcement Actions by the Consumer Division of the Texas Attorney General's Office against debt collectors violating state law.

ATTORNEY GENERAL LITIGATION AND WORK PRODUCT

The AG's pleadings and motions are of far superior quality than those of

most debt collection attorneys, and -- frankly -- consumer defense attorneys

also. This reflects both the quality of their lawyers (assistant attorney

generals do most of the work at the ground level though their superior are

listed above their names on all pleadings) and the institutionalized memory and

experience, not to mention the ready availability of prior legal work products

and briefing, not merely litigation forms and templates.

The AG's civil litigation activities are concentrated in certain areas -

such as regulatory/administrative law, sovereign immunity, public employment

disputes. Much of the litigation work of the AG's office (General Litigation

Division) consists of defending lawsuits against government entities and state

officials or public employees sued in their official capacity (or for conduct

while on duty or connected to their work, such as Section 1983 actions alleging

constitutional violations). Leaving aside the child support enforcement

program, which is also housed in the Office of Attorney General, plaintiff's

litigation by the OAG is the exception, rather than the rule. But the standards

of the legal work are equally high.

There are a few examples where the Consumer Protection Division of the

Attorney General's Office (OAG) has sued debt collectors for questionable

practices. These actions are formally brought in the name of the State of Texas

acting by and through its Attorney General [currently] Greg Abbot, but an

assistant attorney general signs the pleadings and handles the litigation.

Two deserve mention: State of Texas v. Onwuteaka and State of Texas v. Midland et al

STATE OF TEXAS v. MIDLAND FUNDING LLC, MIDLAND CREDIT MANAGEMENT, INC., and

ENCORE CAPITAL GROUP, INC..

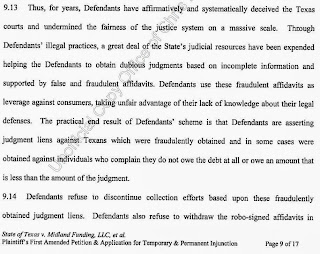

This enforcement action was filed July 8, 2011 in Harris County District

Court over robo-signed affidavits in massive numbers of Midland debt collection

suits filed across the State of Texas in recent years.

The AG's lawsuit resulted in an Agreed Final Judgment and Assurance of Voluntary Compliance half a year later after several rounds of amended pleadings. The Defendants agreed to pay a half-million dollar fine and to shape up with respect to affidavit production and account documentation. Affected consumers got a discount on the amounts of the questionable judgments against them, but weren't precluded by the settlement with the Attorney General (State of Texas) from invoking other remedies on an individual basis. (The obvious one would be a bill of review proceeding in the court that signed the (default) judgment).

|

| Excerpt from amended pleading filed by Texas AG against Midland Funding LLC et al over robosigning |

The AG's lawsuit resulted in an Agreed Final Judgment and Assurance of Voluntary Compliance half a year later after several rounds of amended pleadings. The Defendants agreed to pay a half-million dollar fine and to shape up with respect to affidavit production and account documentation. Affected consumers got a discount on the amounts of the questionable judgments against them, but weren't precluded by the settlement with the Attorney General (State of Texas) from invoking other remedies on an individual basis. (The obvious one would be a bill of review proceeding in the court that signed the (default) judgment).

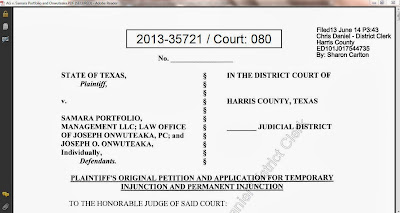

STATE OF TEXAS v. SAMARA PORTFOLIO MANAGEMENT LLC; LAW OFFICE OF JOSEPH

ONWUTEAKA, PC; and JOSEPH O. ONWUTEAKA, individually.

This enforcement action was brought by the Consumer Protection Division of

the AG's Office to stop Attorney Onwuteaka from suing borrowers of

high-interest loans in Justice of the Peace Patronella's court in Downtown

Houston even though they do not live in Harris County. -- > Mandatory venue violation.

In addition to penalties of monetary character, the Attorney General also

seeks injunctive relief as he did in the action against Midland and its

corporate parent and servicer.

Samara Portfolio Management LLC is a debt purchaser that is actually owned by Attorney Joseph Onwuteaka and his wife. He basically hires himself to collect the accounts that he buys up and owns through his LLC (Limited Liability Company).

|

| State of Texas through its Attorney General vs Samara Portfolio Management Enforcement action under DTPA and Texas Debt Collection Act |

Samara Portfolio Management LLC is a debt purchaser that is actually owned by Attorney Joseph Onwuteaka and his wife. He basically hires himself to collect the accounts that he buys up and owns through his LLC (Limited Liability Company).

CASE STYLE: State of Texas v Samara Portfolio Management, LLC et al; Cause No. 2013-35721 in the 80th Judicial District Court of Texas (Harris County)(click link for May 16, 2015 update on status of litigation and record of debt collection attorney Joe Onwuteaka.

Case number for Samara Portfolio Management is 201335721. Next court date is August 2016

ReplyDeleteThis case continues into November 2016.

ReplyDeleteCase number for Samara Portfolio Management is 201335721. Next court date is May, 2017

ReplyDeleteOn June 8, 2017, in Harris County 80th Civil Court, a state court jury found Samara Portfolio Management liable for $25 millon in civil penalties.

ReplyDelete