Fifth Circuit judge Stephen A. Higginson writes separately to stress that "small" violations of the federal Fair Debt Collection Practices Act are still violations of the Act; draws colleagues' criticism for imprudently wading into uncharted territory in case where condo unit owners fought back against the Association, its management company, and the collection law firm and attorney hired by them. Condo owners lost on summary judgment in the District Court in Houston (case info here) and took their beef to the Court of Appeal, which affirmed.

|

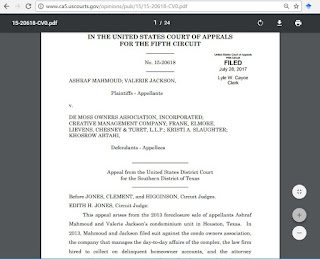

| Link to opinion here. Ashraf Mahmoud, et al v. De Moss Owners Assn, Inc. |

The Condominium Association foreclosed on a unit over partial nonpayment of assessments where part of the amount demanded was more than four years old, and therefor, to all appearances, time-barred. The owners challenged the foreclosure as wrongful and brought unfair debt collection claims against the foreclosure attorney, Kristi A. Slaughter, and her law firm.

"I would hold instead that, consistent with the text and spirit of the Act, demanding full repayment of a partially time-barred debt under the threat of foreclosure—implying that the entirety of the debt is legally enforceable—violates the FDCPA."

In his dissent, Judge Higginson states that he would have remanded the case back to the district court because the Attorney Defendants threatened nonjudicial foreclosure to collect the entirety of a partially time-barred debt in violation of § 1692e(5) of the FDCPA, and implied that the full amount demanded was legally enforceable, in violation of §§ 1692e(2)(A), (10) and 1692f. The COA did, in fact, foreclose on the unit. See image of Trustee's Deed recorded in the Harris County Clerk's Office below:

Section 1692e(5) prohibits threatening to take any action that cannot legally be taken, while Section 1692e(2) prohibits falsely representing . . . the character, amount, or legal status of any debt. Section 1692e(10) prohibits "using false representations or deceptive means to collect or attempt to collect any debt or to obtain information concerning a consumer.

THE GIST OF THE DISSENT

There is no authority for the majority opinion's proposition that when collection letters are only a little bit false, misleading, or unfair, debt collectors cannot be statutorily liable. "Small" violations of the Act are still violations of the Act. See, e.g., Haney v. Portfolio Recovery Assocs., LLC, 837 F.3d 918, 932 (8th Cir. 2016) (finding viable FDCPA claims based on amounts "misstated by $1.29, $1.84, and $0.65" because "there [i]s no de minimis exception to FDCPA liability based upon low dollar amounts").[4]

FULL TEXT OF DISSENTING OPINION

STEPHEN A. HIGGINSON, Circuit Judge, dissenting in part:

Concerned about the consequences for Texas property owners, I respectfully dissent from the majority opinion's holding that threatening to nonjudicially foreclose to collect the entirety of a debt that is partially time-barred cannot violate the FDCPA. The majority opinion emphasizes that this case is unique because of "its summary judgment posture." But the majority opinion affirms summary judgment based on a "hot dispute"—the applicable statute of limitations, which is a legal question to be decided by the court.

And the majority opinion incorrectly holds that, as matter of law, FDCPA claims must fail when "only a small portion of the debt [sought to be collected] may have been time-barred." I would hold instead that, consistent with the text and spirit of the Act, demanding full repayment of a partially time-barred debt under the threat of foreclosure—implying that the entirety of the debt is legally enforceable—violates the FDCPA. We should reverse and remand for further proceedings on Mahmoud and Jackson's claims under 15 U.S.C. §§ 1692e and 1692f.[1]

Because the majority opinion presupposes two elements of Mahmoud and Jackson's FDCPA claims—whether the Act applies to foreclosure-related conduct and whether foreclosure on some of the assessments here was time-barred—I begin by analyzing these two issues.

First, foreclosure-related conduct can be "debt collection" subject to FDCPA regulation. The majority opinion "assumes arguendo" this point, but every circuit that has considered the issue has held that foreclosure-related conduct, particularly demand letters that anticipate foreclosure proceedings, can constitute debt collection and therefore can—if false, misleading, deceptive, or unfair—violate the FDCPA.[2]

Second, as I read Texas law, part of the debts the Attorney Defendants tried to collect here were in fact time-barred from foreclosure. Starting with the general rules in Texas, a creditor must sue for payment of debt "not later than four years after the day the cause of action accrues." Tex. Civ. Prac. & Rem. Code § 16.004(a)(3). If the debt arose from an installment contract, the four-year statute of limitations "begins to run against each installment when it comes due." Palmer v. Palmer, 831 S.W.2d 479, 480 (Tex. App.-Texarkana 1992, no pet.) (collecting cases). As the Attorney Defendants admit, under Texas law, "the time period within which one must sue to recover a debt . . . is also the same period within which one must sue to foreclose upon the lien [securing that debt]." Hoarel Sign Co. v. Dominion Equity Corp., 910 S.W.2d 140, 144 (Tex. App.-Amarillo 1995, writ denied). In other words, a creditor has four years from the date an installment comes due to initiate foreclosure.

Section 16.035 of Texas's Civil Practice and Remedies Code is a statutory exception to these general rules. See Holy Cross Church of God in Christ v. Wolf, 44 S.W.3d 562, 566 (Tex. 2001) ("Section 16.0035 modifies the general rule that a claim accrues and limitations begins to run on each installment when it becomes due."). It provides that "[a] sale of real property under a power of sale in a mortgage or deed of trust that creates a real property lien must be made not later than four years after the day the cause of action accrues" and specifies that if the "real property lien" secures an installment contract, the cause of action does not accrue "until the maturity date of the last note, obligation, or installment." Tex. Civ. Prac. & Rem. Code § 16.035(b), (e). But— as the Attorney Defendants readily admit—this exception, which applies only to specially defined "real property liens," does not cover the condo association's contractually created assessment lien. So the general limitations period still applies.[3]Applying the general rule that the time period for foreclosing on a lien is the same four-year period within which the creditor could have sued to recover the underlying debt, see Hoarel, 910 S.W.2d at 144, the statute of limitations for foreclosing to collect the repair assessments levied against Mahmoud and Jackson in 2006 and 2007 expired in 2010 and 2011, well before the Attorney Defendants sent their first demand letter on October 8, 2012.

Nonetheless, the question remains whether threatening to nonjudicially foreclose on a debtor's home to collect partially time-barred debts violates the FDCPA. Mahmoud and Jackson argue that this conduct violates:

• Section 1692e(2), which prohibits "false[ly] represent[ing] . . . the character, amount, or legal status of any debt";

• Section 1692e(5), which prohibits "threat[ening] to take any action that cannot legally be taken";

• Section 1692e(10), which prohibits "us[ing] . . . false representation[s] or deceptive means to collect or attempt to collect any debt or to obtain information concerning a consumer"; and

• Section 1693f(1), which prohibits "collecti[ng] . . . any amount . . . unless such amount is expressly authorized by the agreement creating the debt or permitted by law."

The majority opinion holds as a matter of law that because "only a small portion of the debt" the Attorney Defendants collected via foreclosure was time-barred, their demand letters cannot violate the FDCPA. This holding contravenes the plain language of the FDCPA and misreads existing Fifth Circuit law.

The FDCPA plainly prohibits a debt collector's using "false, deceptive, or misleading representation[s]" or "unfair or unconscionable means" to collect a debt. §§ 16923, 1692f. There is no authority for the majority opinion's proposition that when collection letters are only a little bit false, misleading, or unfair, debt collectors cannot be statutorily liable. "Small" violations of the Act are still violations of the Act. See, e.g., Haney v. Portfolio Recovery Assocs., LLC, 837 F.3d 918, 932 (8th Cir. 2016) (finding viable FDCPA claims based on amounts "misstated by $1.29, $1.84, and $0.65" because "there [i]s no de minimis exception to FDCPA liability based upon low dollar amounts").[4]

The Act specifically prohibits a debt collector's "threat[ening] to take any action that cannot legally be taken." § 1692e(5) (emphasis added). "Action" is simply "the process of doing something; [one's] conduct or behavior." Action, Black's Law Dictionary (10th ed. 2014). In other words, the FDCPA prohibits a debt collector from threatening to engage in any process, conduct, or behavior that the debt collector cannot legally engage in. See generally Huertas v. Galaxy Asset Mgmt., 641 F.3d 28 (3d Cir. 2011) ("[T]he FDCPA permits a debt collector to seek voluntary repayment of the time-barred debt so long as the debt collector does not initiate or threaten legal action in connection with its debt collection efforts." (emphasis added)). State law may create varying processes (like judicial or nonjudicial foreclosure) that enable creditors to collect on outstanding debts, and the FDCPA—both written broadly and intended to be read broadly, see Daugherty, 836 F.3d at 511—prohibits unlawfully threatening to use any of those processes.

And in Daugherty v. Convergent Outsourcing, Inc., our court held that "a collection letter violates the FDCPA," specifically §§ 1692e(2)(5) and 1692f, "when its statements could mislead an unsophisticated consumer to believe that [the consumer's] time-barred debt is legally enforceable, regardless of whether litigation is threatened." 836 F.3d 507, 509 (5th Cir. 2016). In doing so, we adopted the Sixth Circuit's analysis in Buchanan v. Northland Group, in which the court said, "A misrepresentation about the limitations period amounts to a `straightforward' violation of § 1692e(2)(A)." 776 F.3d 393, 398-99 (6th Cir. 2015). This makes sense: by implying in any way that a time-barred debt is legally enforceable, the debt collector misrepresents "the character . . . or legal status" of the debt, which is a separate example of prohibited conduct under the Act, § 1692e(2)(A).[5] And a debt collector's threatening to foreclose and ultimately foreclosing on someone's home to collect a debt certainly implies that the debt is legally enforceable.

Because the Attorney Defendants threatened nonjudicial foreclosure to collect the entirety of a partially time-barred debt, in violation of § 1692e(5), and thus implied that the full amount demanded was legally enforceable, in violation of §§ 1692e(2)(A), (10) and 1692f, I would remand this case for further proceedings.

[1] As an initial matter, to the best of my review of the record, the Attorney Defendants never actually moved for summary judgment on Mahmoud and Jackson's FDCPA claims under §§ 1692e(2), (5), (10), and 1692f. Mahmoud and Jackson alleged distinct violations of the Act, specifically §§ 1692e, 1692f, and 1692g, in their amended complaint. In the Attorney Defendants' motion for summary judgment, they expressly "limit[ed] their arguments in [the FDCPA] section of their Motion to the requirements of § 1692g." The Attorney Defendants never addressed, and thus never asked for summary judgment on, Mahmoud and Jackson's allegations under §§ 1692e and 1692f. If this review of the record is accurate, the district court erred by "grant[ing] summary judgment sua sponte on grounds not requested by the moving party" without giving the parties' notice and a reasonable opportunity to respond. Baker v. Metro. Life Ins. Co., 364 F.3d 624, 632 (5th Cir. 2004) (citation omitted); see Fed. R. Civ. P. 56(f)(2).

[2] See, e.g., Glazer v. Chase Home Fin., LLC, 704 F.3d 453 (6th Cir. 2013); Reese v. Ellis, Painter, Ratterree & Adams, LLP, 678 F.3d 1211 (11th Cir. 2012); Gburek v. Litton Loan Servicing LP, 614 F.3d 380 (7th Cir. 2010); Wilson v. Draper & Goldberg, PLLC, 443 F.3d 373 (4th Cir. 2006); Piper v. Portnoff Law Assocs., Ltd., 396 F.3d 227 (3d Cir. 2005); Romea v. Heiberger & Assocs., 163 F.3d 111 (2d Cir. 1998); cf. Ho v. ReconTrust Co., 858 F.3d 568 (9th Cir. 2016) (explaining that enforcing a security interest and collecting a debt "are not mutually exclusive").

[3] Overlooking the general rules, the Attorney Defendants argue that because condo association liens don't meet the statutory definition of "real property liens," condo association liens must not be subject to any statute of limitations—a bizarre proposition that the majority opinion rightfully does not entertain.

[4] The majority opinion's reluctance to reach this conclusion may stem from a misimpression that finding an FDCPA violation based on threats to collect partially time-barred debts would "bar" or somehow undo the foreclosure on the whole debt that has already taken place. I do not suggest, nor do I read the damages provision of the FDCPA to mean, that this would be the appropriate result. See § 1692k.

[5] If a debt collector falsely represents the character or legal status of a debt in a demand letter to the debtor, specifically in violation of § 1692e(2)(A), it would seem that the debt collector has also violated the more general example of prohibited conduct in § 1692e(10): "[t]he use of any false representation . . . to collect or attempt to collect any debt. . . ."

MAJORITY OPINION BY EDITH JONES

ASHRAF MAHMOUD; VALERIE JACKSON, Plaintiffs-Appellants,

v.

DE MOSS OWNERS ASSOCIATION, INCORPORATED; CREATIVE MANAGEMENT COMPANY; FRANK, ELMORE, LIEVENS, CHESNEY & TURET, L.L.P.; KRISTI A. SLAUGHTER; KHOSROW ABTAHI, Defendants-Appellees.

United States Court of Appeals, Fifth Circuit.

EDITH H. JONES, Circuit Judge.

This appeal arises from the 2013 foreclosure sale of appellants Ashraf Mahmoud and Valerie Jackson's condominium unit in Houston, Texas. In 2013, Mahmoud and Jackson filed suit against the condo owners association, the company that manages the day-to-day affairs of the complex, the law firm hired to collect on delinquent homeowner accounts, and the attorney responsible for their account. Appellants alleged common law claims for breach of contract, wrongful foreclosure, negligent misrepresentation, and breach of fiduciary duty, and violations of the Federal Debt Collection Practices Act, Texas Fair Debt Collection Practices Act, and Texas Deceptive Trade Practices Act. 15 U.S.C. §§ 1692c, e, and f; Tex. Fin. Code Ann. § 392; Tex. Bus. & Com. Code Ann. § 17. The district court granted summary judgment on all claims. We affirm.

I

In 2001, Mahmoud and Jackson purchased condominium unit 806 located at 6606 De Moss Drive, Houston, Texas. The condo is part of De Moss Condominiums, which is run by the De Moss Owners Association (the Association) and governed by the Condominium Declaration (the Declaration) filed in Harris County, Texas in 1981. Paragraph 5.1 of the Declaration requires all owners to pay monthly assessments and grants the Association the power to assess late fees of $5.00 for each late payment, a late fee that was subsequently increased to $25.00. Common assessments include assessments based on non-recurring costs for repairs and improvements to the common areas of the premises. Paragraph 5.9 grants the Association a lien to secure payment of these assessments. Finally, paragraph 3.10 allows the Association to charge individual owners for repairs to common elements willfully or negligently damaged by an owner or his or her guests.

Creative Management Company (Creative) managed the day-to-day operations of the condo complex. By letter dated August 24, 2012, Creative notified Jackson and Mahmoud that their account was delinquent by $1611.80 and gave them one month to make payment. The letter listed dated and itemized charges, including: a repair from May 2006, a repair from April 2007, a repair from February 2010, maintenance fees from July and August 2012, and an August 2012 late penalty.[1] The letter allowed Jackson and Mahmoud 30 days from receipt to challenge the validity of the debt or the account would be turned over to an agent or an attorney to initiate foreclosure proceedings or to file a lawsuit to recover the total amount due. The Association then turned the collection over to Appellee Kristi Slaughter of Frank, Elmore, Lievens, Chesney & Turet, L.L.P. (Appellee FELCT).

Slaughter sent Mahmoud and Jackson a letter dated October 8, 2012, identifying the balance on the "Resident Transaction Report" maintained by Creative as $2,171.80, and informing Mahmoud and Jackson that the debt was secured by a continuing lien against their condo and failure to pay the total amount within 30 days would result in a nonjudicial foreclosure on the lien. Page one of the letter stated that the balance was secured by a continuing lien against their condominium and that failure to pay the total amount "on or before the expiration of thirty (30) days from and after the date hereof" would result in nonjudicial foreclosure. Page two contained a notice, in all-caps, which included the following warning three times: "UNLESS YOU DISPUTE THE VALIDITY OF THIS DEBT OR ANY PORTION THEREOF WITHIN THIRTY (30) DAYS AFTER RECEIVING THIS LETTER, WE WILL ASSUME THE DEBT IS VALID." Mahmoud and Jackson never disputed the validity of the debt before filing this lawsuit.

Mahmoud and Jackson sent in three checks covering the three most recent monthly assessments ($750), but not the full amount of the debt owed ($2,171.80). Slaughter responded with two separate letters dated November 12, 2012, advising the owners that their unit would be put up for foreclosure sale and returning the checks. The charging of attorneys' fees and assessments had increased the balance due to $2,796.80. The property was posted for nonjudicial foreclosure on December 4, 2012. Both letters gave Mahmoud and Jackson until December 3 to pay the full amount or submit an Association-approved payment plan proposal.

On November 17, Mahmoud and Jackson sent a letter again including three checks for the most recent monthly assessments and requesting a breakdown of all outstanding fees to set up a payment plan. On November 20, 2012, Slaughter responded with the Resident Transaction Report which included all charges dating back to January 2006, returned the partial payment, and reminded them that they needed to establish an approved payment plan with the Association prior to the foreclosure date. A similar set of letters was exchanged a week later—Mahmoud and Jackson sending partial payment on November 27, 2012 and Slaughter returning it on November 28, 2012. Mahmoud acknowledged receiving Slaughter's November 28 letter and admitted that he did not contact the Association, Creative, or the Association's lawyers about its contents.

Slaughter, with the Association's permission, elected to delay the foreclosure sale and gave Mahmoud and Jackson more time to work out a payment plan. Her letter of December 10 confirms this forbearance until January 10, 2013 to make full payment (now increased to $3,321.80) or work out a payment plan. Once again, Mahmoud and Jackson sent an incomplete payment ($240), which was rejected, and no payment plan was forthcoming. A properly noticed foreclosure sale occurred on February 5, 2013. The amount owed to the Association ($4,861.80) was deducted from the sale price ($18,500) and the remainder deposited in the FELCT trust account ($13,638.20). Slaughter held the funds until receipt of a signed release. FELCT paid the $13,638.20 to Mahmoud and Jackson in February 2014. The new owner conveyed the unit back to Mahmoud and Jackson on June 17, 2014 via warranty deed. Ultimately, Mahmoud and Jackson were never dispossessed of the condo.

Mahmoud and Jackson filed suit on multiple common law and statutory claims and sought partial summary judgment as to liability (not damages) in January 2015. In March and April 2015, the Appellees sought summary judgment as to the claims against them. In September 2015, after hearing oral arguments, the district court issued a 23-page Memorandum Opinion and Order and entered judgment in favor of the Appellees. Mahmoud and Jackson timely appealed.

II

This court must "review the trial court's evidentiary rulings under an abuse of discretion standard." Curtis v. M&S Petroleum, Inc., 174 F.3d 661, 667 (5th Cir. 1999). Evidentiary rulings, however, are also subject to harmless error review, "so even if a district court has abused its discretion, we will not reverse unless the error affected `the substantial rights of the parties.'" Heinsohn v. Carabin & Shaw, P.C., 832 F.3d 224, 233 (5th Cir. 2016) (quoting Nunez v. Allstate Ins. Co., 604 F.3d 840, 844 (5th Cir. 2010)).

With the record properly defined, this court then reviews a summary judgment de novo. Wilcox v. Wild Well Control, Inc., 794 F.3d 531, 535 (5th Cir. 2015). Summary judgment is required "if the movant shows that there is no genuine dispute as to any material fact and the movant is entitled to judgment as a matter of law." FED. R. CIV. P. 56(a). This court may affirm the district court's grant of summary judgment on any ground supported by the record and presented to the district court. Hernandez v. Velasquez,522 F.3d 556, 560 (5th Cir. 2008).

III

Mahmoud and Jackson's evidentiary objection was that the Certificate of Corporate Resolution regarding the increased late fees was hearsay, conclusory, and lacked foundation. They moved to strike the exhibit. In their motion for summary judgment, Mahmoud and Jackson additionally raised five new objections, all based on lack of foundation. Appellees argued successfully to the district court that the objections were waived.

On appeal, Mahmoud and Jackson contend that the district court did not identify any authority holding that objections to summary judgment evidence not made the first time the evidence is presented to the court are waived. Regardless whether the district court abused its discretion, however, any error was harmless. The issue whether the late fee increase was properly adopted by the Association is not dispositive of any claims, so it did not affect the outcome of the litigation and did not affect their substantial rights. See Heinsohn, 832 F.3d at 233.

IV

We consider separately each of the claims asserted by Mahmoud and Jackson. First, they argue that the district court erred in granting summary judgment for three different alleged breaches of the Declaration: that the Condo Defendants charged and demanded excessive late fees, wrongfully included time-barred debt in the assessment lien, and charged and ultimately foreclosed upon repair assessments without giving them notice and an opportunity to be heard. Under Texas law, it is a "strict" and "well established rule" that "a party to a contract who is himself in default cannot maintain a suit for its breach." Dobbins v. Redden, 785 S.W.2d 377, 378 (Tex. 1990) (quoting Gulf Pipe Line Co. v. Nearen, 135 Tex. 50, 138 S.W.2d 1065, 1068 (Tex. Comm'n App. 1940)).

Mahmoud and Jackson were indisputably in default under the contract. Paragraph 3.11. of the Declaration states: "Each Owner shall comply strictly with the provisions of this Declaration, the By-Laws and the decisions and resolutions of the Association adopted pursuant thereto." Paragraph 5.9 provides that "[a]ll sums assessed but unpaid by a Unit Owner for its share of Common Expenses chargeable to its respective Condominium Unit . . . shall constitute a lien on such Unit" and expressly gives the Association the right to foreclose on such a lien. Mahmoud and Jackson's failure to pay their balance and to make timely payments on their monthly assessments was a material breach of the Declaration. See E. Friedman & Assoc., Inc. v. ABC Hotel & Rest. Supply, Inc., 412 S.W.3d 561, 565 (Tex. App. 2013) ("One of the considerations in determining whether a breach is material is the extent to which the nonbreaching party will be deprived of the benefit that it could have reasonably anticipated from full performance."). Mahmoud and Jackson's argument that the Association waived the right to timely payment is incorrect; the Association's election to receive untimely payments, for which a late fee was charged, in no way compromised its contractual rights. Likewise, their performance was not prevented or excused by the Association's allegedly erroneous statements about their balance due; this argument, as the Association points out, conflates performance with cure. Summary judgment on this claim was proper.

V

Mahmoud and Jackson next assert that because of material disputed fact issues, their wrongful foreclosure claim should have gone to trial. "A wrongful-foreclosure claim under Texas law has three elements: (i) a defect in the foreclosure sale proceedings; (ii) a grossly inadequate selling price; and (iii) a causal connection between the defect and the grossly inadequate selling price." Villarreal v. Wells Fargo Bank, N.A., 814 F.3d 763, 767-68 (5th Cir. 2016) (quoting Miller v. BAC Home Loans Servicing, L.P., 726 F.3d 717, 726 (5th Cir. 2013). Appellants offer no authority—and we have found none—to support the conclusion that an inaccurate balance included in a default notice constitutes a defect in the foreclosure proceedings, they do not allege that the sale price was grossly inadequate, and they never allege any causal connection between the defect and the sale price. Therefore, the district court did not err on this ground for granting summary judgment.

VI

Although they challenge the adverse summary judgment on their claim for negligent misrepresentation, Mahmoud and Jackson failed to cite specific misrepresentations by the Appellees. A cause of action for negligent misrepresentation in Texas requires: "(1) the representation is made by a defendant in the course of his business, or in a transaction in which he has a pecuniary interest; (2) the defendant supplies `false information' for the guidance of others in their business, (3) the defendant did not exercise reasonable care or competence in obtaining or communicating the information, and (4) the plaintiff suffers pecuniary loss by justifiably relying on the representation." Fed. Land Bank Ass'n v. Sloane, 825 S.W.2d 439, 442 (Tex. 1991).

Both the Attorney and Condo Defendants sought and obtained summary judgment on these claims. But, as just noted, it is not clear what representations Mahmoud and Jackson allege were false or misleading, and there is no evidence that Mahmoud and Jackson either entered into or withdrew from any transaction on the basis of any statements made by the Appellees. See McCamish, Martin, Brown & Loeffler v. F.E. Appling Interests, 991 S.W.2d 787, 791 (Tex. 1999). Again, the district court did not err.

VII

The most legally plausible arguments asserted by Mahmoud and Jackson concern the summary judgment awarded in favor of the Attorney Defendants on the Fair Debt Collection Practices Act (FDCPA) claims. Specifically, the Appellants contend that the debt collection notices sent by the Attorney Defendants were defective, 15 U.S.C. § 1692g, and the Attorney Defendants unlawfully threatened to sue to recover a time-barred debt, see generally 15 U.S.C. §§ 1692e and f.

The FDCPA, 15 U.S.C. § 1692 et seq., imposes civil liability on "debt collector[s]" for certain prohibited debt collection practices. The Act regulates interactions between consumer debtors and "debt collector[s]," defined to include any person who "regularly collects . . . debts owed or due or asserted to be owed or due another." §§ 1692a(5),(6). Attorneys qualify as debt collectors for purposes of the FDCPA when they regularly engage in consumer debt collection, including but not limited to litigation on behalf of a creditor client. Heintz v. Jenkins, 514 U.S. 291, 299, 115 S. Ct. 1489, 1493 (1995). There is no serious contention in this case that the Attorney Defendants were not "debt collectors." Nor is there any dispute that condominium association fees may qualify as debts regulated by the FDCPA. § 1692a(5) (debt is defined as "any obligation or alleged obligation of a consumer to pay money arising out of a transaction in which the money . . . [is] primarily for personal, family, or household purposes. . . ."); see Newman v. Boehm, Pearlstein & Bright, Ltd., 119 F.3d 477, 481-82 (7th Cir. 1997) (homeowners' assessments are debts within FDCPA because they "directly benefit each household in the development").

A.

As an initial matter, the Attorney Defendants maintain an overarching defense that, when they engaged in enforcing the Association's lien by nonjudicial foreclosure, their actions were exempt from the FDCPA except for § 1692(f)(6), which specifies the circumstances under which a debt collector may take or threaten nonjudicial foreclosures:

A debt collector may not use unfair or unconscionable means to collect or attempt to collect any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section: . . . (6) Taking or threatening to take any nonjudicial action to effect dispossession or disablement of property if—(A) there is no present right to possession of the property claimed as collateral through an enforceable security interest; (B) there is no present intention to take possession of the property; or (C) the property is exempt by law from such dispossession or disablement.

This broad proposition was, however, rejected by this court in Kaltenbach v. Richards,which held that "a party who satisfies § 1692a(6)'s general definition of a `debt collector' is a debt collector for the purposes of the entire FDCPA even when enforcing security interests." 464 F.3d 524, 529 (5th Cir. 2006). This court did not, however, decide "whether . . . enforcement of the security interest . . . constituted a `communication in connection with the collection of any debt' within the meaning of § 1692g," Id. at n.5, and we need not address the question in this appeal while addressing each of Mahmoud and Jackson' claims.

B.

Addressing first the Appellants' § 1692g claim, we may assume arguendo that this provision applied to Slaughter's demand letters. The FDCPA requires debt collectors to provide notice that unless the consumer, with thirty days after receipt of the notice, disputes the validity of the debt, or any portion thereof, the debt will be assumed to be valid, § 1692g(a)(3), and no collection activities and communication during the 30-day period may overshadow or be inconsistent with the disclosure of the consumer's right to dispute the debt, § 1692g(b). Courts evaluate any potential deception in debt-related communications under an "unsophisticated" or "least sophisticated" consumer standard. Taylor v. Perrin, Landry, deLaunay & Durand, 103 F.3d 1232, 1236 (5th Cir. 1997). "That is, in determining whether the defendant's actions are deceptive under the FDCPA we must assume that the plaintiff-debtor is neither shrewd nor experienced in dealing with creditors." Goswami v. Am. Collections Enter., Inc., 377 F.3d 488, 495 (5th Cir. 2004).

A fair interpretation of Slaughter's demand letter dated October 8, 2012, pursuant to this stringent standard demonstrates there is no violation of the 30-day rule. "Courts have generally found contradiction or apparent contradiction of the printed § 1692g notice where payment is demanded in a concrete period shorter than the 30-day statutory contest period." McMurray v. ProCollect, Inc., 687 F.3d 665, 670 (5th Cir. 2012) (quoting Peter v. GC Servs. L.P., 310 F.3d 344, 348 (5th Cir. 2002)). We must read the notice in its entirety and then determine if there is a concrete period shorter than is required. Here, the letter stated once on page one that Mahmoud and Jackson needed to pay "on or before the expiration of thirty (30) days from and after the date hereof" or nonjudicial foreclosure would occur. But three times on page two, the letter repeated that "[U]NLESS YOU DISPUTE THE VALIDITY OF THIS DEBT OR ANY PORTION THEREOF WITHIN THIRTY (30) DAYS AFTER RECEIVING THIS LETTER, WE WILL ASSUME THE DEBT IS VALID." This notice does not demand a concrete action period shorter than 30-days from receipt of the letter when read by the least sophisticated consumer.

Reinforcing our conclusion, other circuits have clearly held that if "any confusion created by the ambiguity on the front of the letter dissipates when read in conjunction with the language on the back," then there is no violation. Jacobson v. Healthcare Fin. Servs., Inc., 516 F.3d 85, 93 (2d Cir. 2008) (quoting McStay v. I.C. Sys., Inc., 308 F.3d 188, 191 (2d Cir.2002)). The district court did not err in determining that the notice did not violate § 1692g.

C.

The second set of FDCPA issues raised by Mahmoud and Jackson is that the Attorney Defendants' efforts to collect on allegedly partially time-barred debt violated § 1692e and § 1692f. Concerning § 1692e, they allege violations through "the false representation of" "the character, amount, or legal status of any debt," "[t]he threat to take any action that cannot legally be taken or that is not intended to be taken," and "[t]he use of any false representation or deceptive means to collect or attempt to collect any debt or to obtain information concerning a consumer." 15 U.S.C. § 1692e(2)(A), (5), (10). They claim the Attorney Defendants violated § 1692f by "[t]he collection of any amount (including any interest, fee, charge, or expense incidental to the principal obligation) unless such amount is expressly authorized by the agreement creating the debt or permitted by law." 15 U.S.C. § 1692f(1).

Notably, Mahmoud and Jackson did not take advantage of the verification periods they were offered to challenge any portion of the debt, yet in their lawsuit they contend that any attempt to foreclose based on $541.80 of the original $2,171.80 balance was time-barred. The Texas Property Code clearly states that an association's lien against a unit owner may include: "regular and special assessments, dues, fees, charges, interest, late fees, fines, collection costs, attorney's fees, and any other amount due to the association by the unit owner or levied against the unit by the association." Tex. Prop. Code § 82.113(a). The Declaration declared that assessments against condo owners are "covenants running with the land." Therefore, it is appropriate to examine the whole debt—repairs, monthly assessments, late fees, collection fees, and attorneys' fees—within the context of the Association's lien.

The threshold question is whether any of the debt is time-barred, specifically the portion that originated with two repairs in 2006 and 2007. Formal, itemized demand notices on the overall obligation for condo fees were sent to the owners beginning in August 2012. The parties do not dispute that Mahmoud and Jackson were in default for their condo payments from and after about mid-2012, and as to those there is no question of limitation. There is, however, no Texas case law identifying the statute of limitations that applies to nonjudicial foreclosure of liens on real property created to ensure the payment of condominium association fees and assessments. We do not rule on this novel issue of Texas law but will assume arguendo that limitations barred recovery of this small portion of the debt.[2]

But this preliminary assumption hardly carries the day for Mahmoud and Jackson, as they and the dissent would contend. No authority compels the holding that a nonjudicial foreclosure on a partially time-barred debt can violate FDCPA Sections 1692e or f. In Castro v. Collecto, Inc., 634 F.3d 779, 783 (5th Cir. 2011), this court went only so far as to say that "threatening to sue on time-barred debt may well constitute a violation of the FDCPA." Id. (emphasis added). This court's more recent decision in Daugherty v. Convergent Outsourcing, Inc., 836 F.3d 507 (5th Cir. 2016) extended Castro to the extent it overturned a dismissal on the pleadings and held that "a collection letter that is silent on litigation, but which offers to `settle' a time-barred debt without acknowledging that such debt is judicially unenforceable, can be sufficiently deceptive or misleading to violate the FDCPA." Id. (emphasis added). The court holds merely that seeking collection "can be" violative, which is a far cry from implying, especially in the face of the summary judgment materials before us, that every attempt to collect such a debt infringes FDCPA-created rights.

Daugherty, moreover, is factually distinguishable for three significant reasons. First, there was no dispute that plaintiff's credit card debt had aged "over the course of many years;" the debt had been sold to a collection agency. Id. at 509. Here, less than 25% of the debt is allegedly time-barred. Second, Daugherty was premised on the undisputed assertion that limitations had run as to the entire debt, whereas the application of limitations as a bar to nonjudicial foreclosure here (whether on the whole debt or only the allegedly time-barred portion) is uncertain. Third, Daugherty remarks that the debt collector's offer of a discounted "settlement" that invited partial payment, without disclosing pitfalls like the potential renewal of the entire obligation, could be misleading to the unsophisticated consumer. Id. at 512-13. Here, Mahmoud and Jackson were not misled about the amounts they owed, three quarters of which were not time-barred, nor were they misled about the potential consequence of nonpayment: nonjudicial foreclosure on their condo. That they were not misled is confirmed by the subsequent course of events: the purchaser at foreclosure paid for the condo in an amount fully burdened with the overdue fees and assessments, those amounts were deducted from the purchase price, and a rebate was paid to Mahmoud and Jackson.

For reasons similar to the factual background in Daugherty, the other circuits' cases on which the appellants (and dissent) rely exhibit dubious exercises of collection activity on indisputably and wholly time-barred debt. Buchanan v. Northland Grp, Inc., 776 F.3d 393, 397 (6th Cir. 2015); McMahon v. LVNV Funding, LLC, 744 F.3d 1010, 1020 (7th Cir. 2014). But see Huertas v. Galaxy Asset Mgmt., 641 F.3d 28, 33 ("[i]n the absence of a threat of litigation or actual litigation, no violation of the FDCPA has occurred when a debt collector attempts to collect on a potentially time-barred debt that is otherwise valid," (quoting Freyermuth v. Credit Bureau Svces., Inc., 248 F.3d 767 (8th Cir. 2001).[3] Additionally, both cases were decided in appeals from dismissal on the pleadings, and in each one the courts qualified their holdings. Thus, McMahon states: "We do not hold that it is automatically improper for a debt collector to seek re-payment of time-barred debts; some people might consider full debt re-payment a moral obligation, even though the legal remedy for the debt has been extinguished." 744 F.3d at 1020. The majority in Buchanan concede "[n]or does a `settlement offer' with respect to a time-barred debt by itself amount to a threat of litigation," 776 F.3d at 397, but "consumers might still be confused about the enforceability of a debt or the pitfalls of partial payment." Id. at 400.

To repeat once more, this case is unlike the cases that allowed FDCPA claims to proceed because of (1) its summary judgment posture; (2) the fact that only a small portion of the debt may have been time-barred; and (3) the parties' hot dispute over whether in fact even that small portion was both time-barred and could not be enforced by nonjudicial foreclosure. Without compelling authority, we decline to extend potential FDCPA liability to these circumstances.

It is also important to note that nonjudicial foreclosures on real property are an area traditionally dominated and closely regulated by state law, and federalism concerns are heightened in fields "which the states have traditionally occupied." Rice v. Santa Fe Elevator Corp., 331 U.S. 218, 230, 67 S. Ct. 1146 (1947).

"When one interpretation of an ambiguous federal statute would create a conflict with state foreclosure law and another plausible interpretation would not, we must adopt the latter interpretation." Ho, 840 F.3d at 626. In Ho, the Ninth Circuit, quoting the Supreme Court, declined to "`construe federal law in a manner that interferes with [California's] arrangements for conducting' non-judicial foreclosures." Id. (quoting Sheriff, 136 S. Ct. at 1602). To construe §§ 1692e and f the way Mahmoud and Jackson request would interfere with Texas's carefully articulated arrangements for conducting nonjudicial real property foreclosures by creating causes of action where state law finds no wrongful foreclosure. Moreover, applying these provisions to the debts owed by Mahmoud and Jackson makes no sense, inasmuch as the couple received repeated notices, in compliance with § 1692g as well as state law, and had multiple opportunities short of nonjudicial foreclosure in which to challenge the allegedly time-barred portion.

We do not hold that nonjudicial real property foreclosures in Texas are wholly exempt from the FDCPA; under the facts of this case, however, summary judgment was properly granted on Appellants' §§ 1692e and f claims based on the contention that part of the debts they owed were time-barred.

VIII

Mahmoud and Jackson argue that the district court erred in granting summary judgment to the Attorney Defendants on their claim under the Texas Debt Collection Act (TDCA), Tex. Fin. Code Ann. § 392.304(a)(8), asserting that "the summary judgment proof shows Slaughter's demands and threat of foreclosure were based in part on time-barred debt." They do not identify—nor have we found—any authority that supports the position that attempts to collect time-barred debt violate the TDCA. This argument is therefore forfeited for lack of sufficient briefing. See FED. R. APP. P. 28(a)(8)(A).

The Texas Deceptive Trade Practices Act (DTPA) provides that "a consumer" may bring an action for a variety of deceptive business practices listed under the Act. Tex. Bus. & Com. Code Ann. § 17.50(a). The district court held that "[t]he payment of monthly maintenance fees to a condominium association does not constitute a `purchase' under the DTPA, such that a unit owner, like the plaintiff, would qualify as a consumer." On appeal, despite the Texas Supreme Court's clear and consistent holdings that "[o]nly a `consumer' can maintain a cause of action directly under the DTPA," Mahmoud and Jackson do not contend that they are consumers within the statute's meaning. Crown Life Insurance v. Casteel, 22 S.W.3d 378, 386 (Tex. 2000); Cruz v. Andrews Restoration, Inc., 364 S.W.3d 817, 822 (Tex. 2012); Melody Home Mfg. Co. v. Barnes,741 S.W.2d 349 (Tex. 1987); Flenniken v. Longview Bank and Trust Co., 661 S.W.2d 705, 706 (Tex. 1983). Therefore, the district court did not err.

IX

Mahmoud and Jackson argue that the district court erred in granting summary judgment on their claim that the Attorney Defendants breached their fiduciary duty when they refused to deliver the excess foreclosure sale proceeds without a release. This claim is meritless. The existence of a fiduciary relationship between the plaintiffs and defendants is a prerequisite to finding a breach of duty. Jones v. Blume, 196 S.W.3d 440, 447 (Tex. App.-Dallas 2006, pet. denied). Mahmoud and Jackson cannot establish that the Attorney Defendants owed them a fiduciary duty. Indeed, this court has specifically observed that foreclosure trustees do not owe the party subject to the foreclosure sale a fiduciary duty. Stephenson v. LeBoeuf, 16 S.W.3d 829, 837 (Tex. App. 14th 2000).

X

Finally, Mahmoud and Jackson sought declaratory relief "to determine their rights and true obligations under the agreements and statutes governing their ownership of the Property." They make assertions about the obligations created by the Declaration, but there is neither supporting argument nor case law authority. This argument is forfeited for lack of sufficient briefing. See FED. R. APP. P. 28(a)(8).

* * *

For the foregoing reasons, we AFFIRM the district court's judgment.

[1] The letter included a breakdown of the balance:

05/10/2006 09/05REPAIR 195.00

04/09/2007 PLUMBING REPAIR 346.80

02/16/2010 ROYAL INVESTMENT SVC 575.00

07/01/2012 MAINTENANCE FEES 220.00

08/01/2016 MAINTENANCE FEES 250.00

08/16/2012 LATEPENALTY 25.00

_________

1,611.80

[2] The linchpin of the dissent is the superficial conclusion that under Texas law, a suit may not be filed to collect a "debt" that accrued more than four years before the instigation of litigation. Tex. Civ. Prac. & Rem. Code Ann. Sec. 16.004(a)(3). Because a lien at common law is "simply an incident of, and inseparable from the debt which it secures," it has been held that "if limitations prevent collection of the debt, the lien becomes unenforceable." Hoarel Sign Co. v. Dominion Equity Corp., 910 S.W.2d 140, 144 (Tex. App. 1995), writ denied(May 10, 1996). But the dissent's wading into this uncharted territory is imprudent and inconclusive. First, the intermingling of the obligations to pay ongoing fees and assessments with the continuing lien makes this an unique case under Texas law. Condominium association fees and assessments are governed by a specific section of the Texas Property Code, Sec. 82.113, which prescribes enforcement by nonjudicial foreclosure according to the procedures prescribed for real property liens, Tex. Prop. Code Ch. 52. A four-year statute of limitations governs foreclosures of "real property liens", but the cause of action for foreclosure does not accrue on an installment obligation "until the maturity date of the last note, obligation, or installment." Tex. Civ. Prac. & Rem. Code Ann. Sec. 16.035(b), (e). It is true that Sec. 16.035(g)'s definition of "real property lien" does not appear to cover condominium association fees. The obligation to pay such fees, however, has been described by the Texas Supreme Court as a covenant running with the land and as creating a contractual lien on the real property. But cf. Hoarel Sign Co., 910 S.W.2d at 144 (applying common law limitations because the materialmen's lien there derived from improvements "that d[id] not become part of the real estate.)" It is possible that a lacuna exists in Texas's limitations statutes for these types of assessments and fees. Cf. Tex .Civ. Prac. & Rem. Code Sec. 16.051 (residual limitations statute excludes actions for foreclose real property).

Second, even if a four-year statute applies, exactly when and how limitations began to run on Mahmoud and Jackson's obligations is unclear. For instance, it has been held that no limitations bar prevents suit by a party to an open account where the defendant did not prescribe and the court accordingly presumes that any payments received should have been applied to the oldest outstanding obligation. Watson v. Cargill, Inc., Nutrena Div.,573 S.W.2d 35 (Tex. Civ. App-Waco, 1978); Prowell v. Berry-Barnett Gro. Co., 462 S.W.2d 53 (Tex. Civ. App.-Waco, 1970) (writ refused). It has also been held, in a suit for partition, where a cotenant makes improvements to or pays expenses for jointly owned property, which benefit the common ownership, the cotenant may recover them irrespective of statutes of limitations so long as the cotenancy continued. Tapp v. Tapp, 134 S.W.2d 683 (Tex. Civ. App.-Texarkana 1939). Finally, it has been held that where a deed of trust authorized the trustee to pay taxes and insurance, i.e. ongoing costs, on mortgaged property, "the mere fact that the debt was barred [by limitations] does not . . . make against the deed of trust lien securing the taxes and insurance subsequently paid." Burke v. Guilford Mtg. Co., 161 S.W.2d 574, 582 (Tex. Civ. App.-Dallas 1942).

[3] We are bound by Daugherty, but I agree with the broader principles expressed in Huertas, Freyermuth, and in Judge Kethledge's dissent in Buchanan Grp., 776 F.3d at 400-02. In nearly every state, the fact that a debt is time-barred from collection by a lawsuit does not extinguish the obligation. And particularly where a collection letter threatens no legal action, even an unsophisticated debtor knows enough to throw it away. Using moral suasion in these matters is not abusive or overbearing.

FULL TEXT OF DISTRICT COURT OPINION

ASHRAF MAHMOUD, et al., Plaintiffs,

v.

DE MOSS OWNERS ASSOCIATION, INC., et al., Defendants.

United States District Court, S.D. Texas, Houston Division.

MEMORANDUM OPINION AND ORDER

KENNETH M. HOYT, District Judge.

I. INTRODUCTION

Pending before the Court are the following: (1) the plaintiffs', Valerie Jackson and Ashraf Mahmoud (the "plaintiffs"), motion for partial summary judgment (Dkt. No. 31), and responses and replies thereto (Dkt. Nos. 36, 39, 42 & 43); the defendants, Frank, Elmore, Lievens, Chesney & Turet, L.L.P. and Kristi Slaughter motions for summary judgment (Dkts. No. 60 & 62), and responses and replies thereto (Dkt. Nos. 70 & 75)[1]; and the defendants, De Moss Owners Association, Inc. and Creative Management Company, motion for summary judgment (Dkt. No. 64) and responses and replies thereto (Dkt. Nos. 74 & 76). After having conducted a hearing on this matter and having carefully considered the motions, responses, replies, pleadings, the record, and the applicable law, the Court determines that the defendants' motions for summary judgment should be GRANTED; and the plaintiffs' motion for partial summary judgment should be DENIED.

II. FACTUAL OVERVIEW

This is an unfair debt collection and wrongful foreclosure case involving the plaintiffs' condominium unit in Houston, Texas. The defendant, De Moss Owners Association, Inc. (the "Association"), is the owners' association that governs the condominium complex. The defendant, Creative Management Company ("CMC"), manages the day-to-day affairs of the condominium complex for the Association. On or about January 25, 2001, the plaintiffs purchased Condominium Unit No. 806 (the "Unit") and became bound by the Declaration and Bylaws of the Association.

Pursuant to Section 5.1 of the Declaration, every unit owner is required to pay monthly assessments, and under Section 5.9 of the Declaration, the Association is granted a lien against each unit to secure payment of those assessments. The plaintiffs acknowledge that as property owners, they are required to pay monthly assessments. When the Declaration was filed in 1981, Section 5.1 authorized the Association to charge a late fee in the amount of $5.00 for each assessment paid after the 15th of each month. The plaintiffs do not dispute that they were obligated to pay their assessments by the 15th of each month or else be subject to late fees. Twenty-six years later, in 2007, the Association's Board authorized an increase in the late fee to $25.00 pursuant to the statutory power to assess and impose late fees granted to the Board under Tex. Prop. Code § 82.102(a)(12).[2] This resolution was not filed in the real property records until February 2014, subsequent to the January 1, 2012 effective date of the applicable property code provision requiring the same. Beginning in June 2009, the plaintiffs' assessment payments became increasingly irregular and repair costs, together with rule violation fines, continued to be assessed against their Unit's account. By October 5, 2012, the total balance due on their account had reached $2,171.80.

The Association hired the defendant, Attorney Kristi Slaughter ("Slaughter") with the law firm of Frank, Elmore, Lievens, Chesney & Turet, LLP ("the law firm") ("Slaughter" and "the law firm" together, the "attorney defendants") to collect on the debt associated with the plaintiffs' Unit. Accordingly, pursuant to a two-page demand letter dated October 8, 2012, Slaughter advised the plaintiffs that unless the balance on their Unit account was paid in full on or before the expiration of thirty (30) days from the date of the letter, the Association would commence foreclosure proceedings against their Unit. At the very top of the second page of the letter, Slaughter included a debt validation notice, advising the plaintiffs of the law firm's attempt to collect a debt and further informing them that they had thirty days within which to dispute the debt. On November 12, 2012, Slaughter sent the plaintiffs a foreclosure notice advising them that their Unit had been posted for foreclosure sale scheduled for December 4, 2012, and returning checks forwarded by the plaintiffs on November 9, 2012, covering the three most recent monthly assessment payments. Slaughter further advised the plaintiffs that if they wished to submit a payment plan to the Board, they needed to do so, have it approved and reduced to writing prior to the foreclosure sale. The foreclosure sale date was eventually rescheduled for February 5, 2013, in an attempt to work toward resolving the plaintiffs' outstanding debt.

On February 5, 2013, the plaintiff's Unit was sold to Khosrow Abtahi, who submitted and paid the highest bid of $18,500.00. After deducting the amount owed to the Association, $13,638.20 in excess proceeds remained. Because it received no claims to the excess proceeds, on February 20, 2014, the law firm paid $13,638.20 to the plaintiffs. Abtahi commenced eviction proceedings against the plaintiffs which were subsequently dismissed for want of prosecution on July 1, 2013. By deed dated June 17, 2013, Abtahi conveyed the Unit back to the plaintiffs. Thus, the plaintiffs were never forced out of the Unit.

On June 14, 2013, the plaintiffs commenced the instant action against the defendants alleging that they violated both state and federal debt collection and/or consumer protection statutes by, inter alia, conducting a foreclosure sale premised on time-barred amounts[3] and amounts improperly added to the lien balance. The defendants now move for summary judgment on all of the plaintiffs' claims. The plaintiffs have also filed a motion for partial summary judgment, seeking summary judgment as to liability, leaving damages and attorneys' fees to be decided at trial.

III. SUMMARY JUDGMENT STANDARD

Rule 56 of the Federal Rules of Civil Procedure authorizes summary judgment against a party who fails to make a sufficient showing of the existence of an element essential to the party's case and on which that party bears the burden at trial. See Celotex Corp. v. Catrett, 477 U.S. 317, 322 (1986); Little v. Liquid Air Corp., 37 F.3d 1069, 1075 (5th Cir. 1994) (en banc). The movant bears the initial burden of "informing the district court of the basis for its motion" and identifying those portions of the record "which it believes demonstrate the absence of a genuine issue of material fact." Celotex, 477 U.S. at 323; see also Martinez v. Schlumber, Ltd., 338 F.3d 407, 411 (5th Cir. 2003). Summary judgment is appropriate where "the pleadings, the discovery and disclosure materials on file, and any affidavits show that there is no genuine issue as to any material fact and that the movant is entitled to judgment as a matter of law." Fed. R. Civ. P. 56(c).

If the movant meets its burden, the burden then shifts to the nonmovant to "go beyond the pleadings and designate specific facts showing that there is a genuine issue for trial." Stults v. Conoco, Inc., 76 F.3d 651, 656 (5th Cir. 1996) (citing Tubacex, Inc. v. M/V Risan, 45 F.3d 951, 954 (5th Cir. 1995); Little, 37 F.3d at 1075). "To meet this burden, the nonmovant must `identify specific evidence in the record and articulate the `precise manner' in which that evidence support[s] [its] claim[s].'" Stults, 76 F.3d at 656 (citing Forsyth v. Barr, 19 F.3d 1527, 1537 (5th Cir.), cert. denied, 513 U.S. 871, 115 S. Ct. 195, 130 L. Ed.2d 127 (1994)). It may not satisfy its burden "with some metaphysical doubt as to the material facts, by conclusory allegations, by unsubstantiated assertions, or by only a scintilla of evidence." Little, 37 F.3d at 1075 (internal quotation marks and citations omitted). Instead, it "must set forth specific facts showing the existence of a `genuine' issue concerning every essential component of its case." Am. Eagle Airlines, Inc. v. Air Line Pilots Ass'n, Intern., 343 F.3d 401, 405 (5th Cir. 2003) (citing Morris v. Covan World Wide Moving, Inc., 144 F.3d 377, 380 (5th Cir. 1998)).

"A fact is material only if its resolution would affect the outcome of the action, . . . and an issue is genuine only `if the evidence is sufficient for a reasonable jury to return a verdict for the [nonmovant].'" Wiley v. State Farm Fire and Cas. Co., 585 F.3d 206, 210 (5th Cir. 2009) (internal citations omitted). When determining whether a genuine issue of material fact has been established, a reviewing court is required to construe "all facts and inferences . . . in the light most favorable to the [nonmovant]." Boudreaux v. Swift Transp. Co., Inc., 402 F.3d 536, 540 (5th Cir. 2005) (citing Armstrong v. Am. Home Shield Corp., 333 F.3d 566, 568 (5th Cir. 2003)). Likewise, all "factual controversies [are to be resolved] in favor of the [nonmovant], but only where there is an actual controversy, that is, when both parties have submitted evidence of contradictory facts." Boudreaux, 402 F.3d at 540 (citing Little, 37 F.3d at 1075 (emphasis omitted)). Nonetheless, a reviewing court is not permitted to "weigh the evidence or evaluate the credibility of witnesses." Boudreaux, 402 F.3d at 540 (quoting Morris, 144 F.3d at 380). Thus, "[t]he appropriate inquiry [on summary judgment] is `whether the evidence presents a sufficient disagreement to require submission to a jury or whether it is so one-sided that one party must prevail as a matter of law.'" Septimus v. Univ. of Hous.,399 F.3d 601, 609 (5th Cir. 2005) (quoting Anderson v. Liberty Lobby, Inc., 477 U.S. 242, 251-52 (1986)).

IV. ANALYSIS AND DISCUSSION

A. The Plaintiffs' Claim for Violation of the Fair Debt Collection Practices Act

The plaintiffs, in their First Claim for Relief referenced in their First Amended Complaint, allege that they are "consumers" within the meaning of the Fair Debt Collection Practices Act ("FDCPA"), 15 U.S.C. § 1692a(3), and the attorney defendants, as debt collectors, sought to collect a debt from them by way of false, deceptive and misleading representations and unfair or unconscionable means in violation of the FDCPA. (SeeDkt. No. 4, ¶¶ 47-52). They also assert that the debt validation notices contained in the defendants' demand letters, as required by 15 U.S.C. § 1692g, were overshadowed and/or contradicted by the contents contained in the demand portion of such letters. (Id.) As such, the plaintiffs assert that they are entitled to statutory damages, actual damages, attorneys' fees and costs for the defendants' numerous violations. (Id., ¶ 52).

"The purpose of the FDCPA is to `eliminate abusive debt collection practices by debt collectors, to insure that those debt collectors who refrain from using abusive debt collection practices are not competitively disadvantaged, and to promote consistent State action to protect consumers against debt collection abuses.'" Bittinger v. Wells Fargo Bank NA, 744 F. Supp.2d 619, 626 (S.D. Tex. 2010) (quoting 15 U.S.C. § 1692(e)). A "debt collector" is defined, within the meaning of the FDCPA, as "any person who uses any instrumentality of interstate commerce or the mails in any business the principal purpose of which is the collection of any debts, or who regularly collects or attempts to collect, directly or indirectly, debts owed or due or asserted to be owed or due another." 15 U.S.C. § 1692a(6). "The activity of foreclosing on a property pursuant to a deed of trust[, however,] is not the collection of debt within the meaning of the FDCPA." Bittinger, 744 F. Supp.2d at 626 (citing Williams v. Countrywide Home Loans, Inc., 504 F. Supp.2d 176, 190 (S.D. Tex. 2007), aff'd, 269 Fed. Appx. 523 (5th Cir. 2008)); see also Brown v. Morris, No. 04-60526, 2007 WL 1879392, at 3 (5th Cir. June 28, 2007) (acknowledging that the Fifth Circuit has "implicitly recognized that a foreclosure is not per se FDCPA debt collection.").

Additionally, the defendants' actions cannot be deemed "unfair" or "unconscionable" under the FDCPA since the plaintiffs were in default at the time of the foreclosure sale and the attorney defendants relied on the Associations and/or CMC's representations as to the underlying basis for conducting the foreclosure sale, as permitted by law. See15 U.S.C. § 1692f (allowing a FDCPA claim for collecting a debt utilizing unfair or unconscionable means); Tex. Prop. Code § 51.007(f) (stating that a trustee shall not be liable for any good faith error resulting from reliance upon information provided by a mortgagee or their respective attorney, agent or other third party). Further, a non-debt collector, such as the Association and/or CMC, generally cannot be held vicariously liable for a debt collector's purported FDCPA violations. See Boles v. Moss Codilis, LLC, Civil Action No. 2011 WL 2618791, at *4 (W.D. Tex. July 1, 2011) (noting that "several courts have rejected the notion of holding a creditor or other non-debt collector vicariously liable for the actions of a debt collector."). Finally, this Court determines that nothing in the attorney defendants' demand and/or debt-collection letters overshadowed or contradicted the validation notices contained therein so as to constitute a violation of § 1692g. See Osborn v. Ekpsz, LLC, 821 F. Supp.2d 859, 875 (S.D. Tex. 2011) (holding that debt collector did not violate § 1692g by demanding that consumer contact it "within the next thirty (30) days" or it would notice her deposition and require document production where such demand was followed by a validation notice clearly stating that consumer had a right to dispute the debt and request validation within 30 days of receipt of the letter). Hence, the defendants are entitled to judgment as a matter of law on the plaintiffs' claims brought pursuant to the FDCPA.

B. The Plaintiffs' Claim for Violation of the Texas Debt Collection Act

The plaintiffs, in their Second Claim for Relief referenced in their First Amended Complaint, allege that the attorney defendants are "third-party debt collectors" and, as such, are liable under the Texas Debt Collection Act ("TDCA"), Tex. Fin. Code §§ 392.001, for multiple violations. (Dkt. No. 4, ¶¶ 54-64). They also contend that because Slaughter and the law firm acted as attorneys for the Association and/or CMC in their debt collection efforts, the Association and CMC are liable for their unlawful acts. (Id.)

The TDCA "prohibits debt collectors from using various forms of threatening, coercive, harassing, or abusive conduct to collect debts from consumers." Porterfield v. JP Morgan Chase, N.A., No. SA-12-CV-815-DAE, 2014 WL 3587783, at 21 (W.D. Tex. July 21, 2014). A "debt collector" within the meaning of the Act is defined, in relevant part, to include "a person who directly or indirectly engages in debt collection." Tex. Fin. Code § 392.001(6). The TDCA "protects `consumers' and the only prerequisite to `consumer' status is having a `consumer debt.'" Id. (citing Tex. Fin. Code § 392.001(1)). A "consumer debt' under the TDCA is defined as "an obligation, or alleged obligation, primarily for personal, family or household purposes and arising from a transaction or alleged transaction." Tex. Fin. Code § 392.001(2). The plaintiffs in this case allege that the defendants committed at least six violations of the TDCA in foreclosing the Association's lien, specifically including violations of Tex. Fin. Code §§ 392.101, 392.304(a)(5), 392.301(a)(8), 392.303(a)(2), 392.303, and 392.304(a)(8).

Even assuming arguendo that the attorney defendants are construed to be "debt collectors" for purposes of the TDCA, this Court is of the opinion that the plaintiffs do not state a colorable claim for violations of §§ 392.101, 392.304(a)(5), 392.301(a)(8), 392.303(a)(2), 392.303 or 392.304(a)(8). The plaintiffs allege that the attorney defendants violated Tex. Fin. Code §392.101, by failing to have a $10,000 bond on file with the Texas Secretary of State. The plaintiffs also allege that the attorney defendants violated Tex. Fin. Code § 392.304(a)(5), by failing to give certain disclosures described therein. Both of the aforementioned provisions, however, based on their plain language, are inapplicable to the defendants as they apply only to "third-party debt collectors,[4]" which, in accordance with its statutory definition, does not include "attorney[s] collecting a debt as [] attorney[s] on behalf of and in the name of a client." See Tex. Fin. Code § 392.001(7).[5]

Next, the plaintiffs allege that the attorney defendants violated 392.301(a)(8), by using threats and coercion and then taking action, such as foreclosure, which was prohibited by law.[6] Courts have specifically held that the TDCA does not prevent debt collectors from conducting a non-judicial foreclosure pursuant to a power of sale and/or deed of trust. See Carrillo v. Bank of Am., N.A., No. 12-cv-3906, 2013 WL 1558320, at *7 (S.D. Tex. Apr. 11, 2013). In fact, the TDCA expressly states that it "does not prevent a debt collector from. . . exercising or threatening to exercise a statutory or contractual right of seizure, repossession, or sale that does not require court proceedings." Tex. Fin. Code § 392.301(b)(3). Moreover, § 51.002 of the Texas Property Code authorizes non-judicial foreclosure proceedings, thus there was no violation of § 392.301(a)(8) by the defendants.

The plaintiffs also allege that the attorney defendants violated 392.303(a)(2), by using unfair or unconscionable means to collect charges and fees that were not expressly authorized by the Declaration or legally chargeable to them.[7] Specifically, the plaintiffs contend that the Declaration did not authorize an increase in the late fee from $5 to $25. Although the Declaration initially authorized that a late fee in the amount of $5 may be imposed as an assessment, nothing contained therein prevented the Association's Board from ever increasing this fee amount. Additionally, § 82.102(a)(12) of the Texas Property Code expressly provides that "[u]nless otherwise provided by the declaration, the association, acting through its board, may . . . impose interest and late charges for late payments of assessments, returned check charges, and, if notice and an opportunity to be heard are given .. . reasonable fines for violations of the declaration, bylaws, and rules of the association." Tex. Prop. Code § 82.102(a)(12). "Assessments" are defined within the meaning of the Texas Property Code to include "regular and special assessments, dues, fees, charges, interest, late fees, fines, collection costs, attorney's fees, and any other amount due to the association by the unit owner or levied against the unit by the association, all of which are enforceable as assessments under this section unless the declaration provides otherwise." Tex. Prop. Code § 82.113(a). The Texas Property Code further provides that "[a]n assessment levied by the association against a unit or unit owner is a personal obligation of the unit owner and is secured by a continuing lien on the unit and on rents and insurance proceeds received by the unit owner and relating to the owner's unit." Id. When, where as here, the Declaration does not prohibit the Association's Board from increasing the late fee amount, the Association acted well within its right to increase the late fee amount from $5 to $25 and its actions in this regard cannot be deemed "unfair" or "unconscionable."

The plaintiffs further allege that the attorney defendants violated 392.304(a)(8)[8], by using fraudulent, deceptive or misleading representations "by misrepresenting the amount of the debt (including the $25 late fee when the Declaration only authorizes imposition of a $5 late fee)." (Dkt. No. 31 at 22, ¶ 4). The plaintiffs claim in this regard pertaining to the $25 late fee fails for the same reasons stated above. Finally, with respect to the plaintiffs' claims regarding any other disputed debt amounts and/or older charges, based on plaintiff Valerie Jackson's own admissions, there were no incorrect or misrepresented amounts that she could, indeed, attest to on the Resident Transaction Report. (See Dkt. No. 64, Ex. B. at 154:10-155:16). Without more, the plaintiffs have failed to raise a genuine issue of material fact on their TDCA claims and the defendants are entitled to judgment as a matter of law on the plaintiffs' claims for violations of the TDCA.

C. The Plaintiffs' Claim for Violation of the Deceptive Trade Practices Act

The plaintiffs, in their Third Claim for Relief referenced in their First Amended Complaint, allege that the defendants are liable under the Texas Deceptive Trade Practices Act ("DTPA"), Tex. Bus. & Com. Code §§ 17.01-17.926, for the same conduct discussed at length above. In order to state a claim under the DTPA, a plaintiff must establish that: "(1) the plaintiff is a consumer; (2) the defendant engaged in false, misleading, or deceptive acts; and (3) these acts constituted a producing cause of the consumer's damages. Taylor v. Ocwen Loan Servicing, LLC, Civil Action No. H-12-2929, 2013 WL 3353955, at *4 (S.D. Tex. July 3, 2013) (quoting Doe v. Boys Clubs of Greater Dallas, Inc., 907 S.W.2d 472, 478 (Tex. 1995) (citing Tex. Bus. & Com. Code § 17.50(a)(1)). To qualify as a "consumer" under the DTPA, a plaintiff must have sought or acquired goods or services by purchase or lease, and the goods or services must form the basis of the complaint. See Miller v. BAC Home Loans Servicing, L.P., 726 F.3d 717, 725 (5th Cir. 2013) (citing Flenniken v. Longview Bank & Trust Co., 661 S.W.2d 705, 708 (Tex. 1983)); see also Miller Cushman v. GC Servs., LP, 657 F. Supp.2d 834, 843 (S.D. Tex. 2009); Tex. Bus. & Com Code § 17.45(4).

Here, the plaintiffs are not "consumers" within the meaning of the DTPA because the basis of their claims concerns alleged wrongful foreclosure activities, rather than the purchase or lease of goods or services. The payment of monthly maintenance fees to a condominium association does not constitute a "purchase" under the DTPA, such that a unit owner, like the plaintiff, would qualify as a consumer. See Riddick v. Quail Harbor Condo. Ass'n, Inc., 7 S.W.3d 663, 669-70 (Tex. App.-Houston [14 Dist.] 1999) (reasoning that condo unit owner's payment of monthly maintenance fees to its association did not constitute a "purchase" within the meaning of the DTPA). The plaintiffs' claim that they are consumers because they sought or acquired condominium management services for which they were charged is without merit. Thus, because the plaintiffs cannot demonstrate "consumer" status under the DTPA, they "cannot maintain a DTPA action, and cannot claim DTPA damages under a tie-statute, such as the TDCA." Burnette v. Wells Fargo Bank, N.A., No. 4:09-CV-370, 2010 WL 1026968 at *9 (E.D. Tex. Feb. 16, 2010). Accordingly, the defendants are entitled to a summary judgment on the plaintiffs' DTPA claim.

D. The Plaintiffs' Claim for Wrongful Foreclosure

The plaintiffs, in their Fourth Claim for Relief, allege that all of the defendants are liable for wrongfully foreclosing on their Unit. The plaintiffs contend that they are entitled to recover damages for wrongful foreclosure because there were multiple irregularities in the foreclosure sale that caused them damages. (Dkt. No. 4 at ¶ 77 at 24). "Under Texas common law, a debtor may recover for wrongful foreclosure when an irregularity in the foreclosure sale contributes to recovery of an inadequate price for the property." Matthews v. JPMorgan Chase Bank, NA, No. 3:11-CV-00972-M, 2011 WL 3347920, at *2 (N.D. Tex. Aug.1, 2011) (citing Am. Sav. & Loan Ass'n of Hous. v. Musick, 531 S.W.2d 581, 587 (Tex. 1975)). "The elements of a wrongful foreclosure claim are: (1) a defect in the foreclosure sale proceedings; (2) a grossly inadequate selling price; and (3) a causal connection between the defect and the grossly inadequate selling price." Sauceda v. GMAC Mortg. Corp., 268 S.W.3d 135, 139 (Tex. App.- Corpus Christi 2008, no pet.); see also Pollett v. Aurora Loan Servs., No. 11-50059, 2011 WL 6412051, at *1 (5th Cir. Dec. 21, 2011).

Although the plaintiffs have alleged that there were "multiple irregularities" in the foreclosure sale of the Unit, they have set forth no evidence identifying any alleged defects or irregularities in the foreclosure sale. The record demonstrates that the attorney defendants followed the procedures required under the Texas Property Code for providing proper notice of the foreclosure sale and for conducting the sale. No competent summary judgment evidence has been adduced establishing that there was a defect in the foreclosure sale proceedings or that the ultimate sales price of $18,500.00 was a "grossly inadequate" sales price.[9] Additionally, the plaintiff, Valerie Jackson, acknowledged during her deposition that she was unaware of any conduct attributable to the defendants that may have discouraged or prevented anyone from submitting a bid at the foreclosure sale with respect to the Unit. (See Dkt. No. 64, Ex. B at 174:25-176:3.). Moreover, no causal connection exists between any alleged sales defect and a grossly inadequate sales price. Finally, the plaintiffs did not suffer any actionable harm since they never lost possession of the Unit. See Motten v. Chase Home Fin., 831 F. Supp.2d 988, 1007 (S.D. Tex. 2011) (citing Baker v. Countrywide Home Loans, Inc., No. 3:08-CV-0916-B, 2009 WL 1810336, *4 (N.D. Tex. June 24, 2009) ("Because recovery is premised upon one's lack of possession of real property, individuals never losing possession of the property cannot recover on a theory of wrongful foreclosure. As such, courts in Texas do not recognize an action for attempted wrongful foreclosure.")).

Furthermore, the attorney defendants are immune from suit because they cannot be sued by the plaintiffs for actions taken within the scope of their representation of the Association. The attorney defendants were retained by the Association to assist in the foreclosure of the Unit. The record establishes that they had no contact with the plaintiffs beyond their capacity as "legal counsel" for the Association and they committed no wrongful acts outside of the scope of their representation. See Campbell v. Mortg. Elec. Registration Sys, Inc., No. 03-11-00429-CV, 2012 WL 1839357, at *5 (Tex. App.-Austin May 18, 2012, pet. denied) ("An attorney enjoys `qualified immunity,' with respect to non-clients, for actions taken in connection with representing a client in litigation. . . . An attorney's conduct, even if frivolous or without merit, while potentially sanctionable by the court, is not independently actionable if the conduct is part of the discharge of the lawyer's duties in representing its client.") (internal citations omitted). Therefore, the attorney defendants are entitled to a summary judgment on the plaintiffs' claim for wrongful foreclosure.

With regard to the defendant, CMC, it had no authority to authorize any foreclosure sale and no involvement in the sale. As such, CMC is entitled to judgment as a matter of law with regard to the plaintiffs' wrongful foreclosure claim.

E. The Plaintiffs' Claim for Breach of Contract Against the Association/CMC

The plaintiffs, in their Fifth Claim for Relief, assert that the Association and CMC were bound to act in accordance with the Declaration and By-laws and that they breached the Declaration by charging and demanding, under threats of foreclosure, amounts not properly included in the assessment lien against the Unit. (Dkt. No. 4, First Amend. Compl. ¶ 79 at 25.) The plaintiffs also assert that there are other wrongful amounts that form the lien, including the $25 late-fee charge and older charges for miscellaneous violations and chargeback costs for repairs.

To prevail on a breach of contract claim under Texas law, proof of the following essential elements is required: "(1) the existence of a valid contract; (2) performance or tendered performance by the plaintiff; (3) breach of the contract by the defendant; and (4) damages sustained by the plaintiff as a result of the breach." Mullins v. TestAmerica, Inc., 564 F.3d 386, 418 (5th Cir. 2009) (quoting Aguiar v. Segal, 167 S.W.3d 443, 450 (Tex. App.-Houston [14th Dist.] 2005, pet. denied)). In order to be considered valid and binding, a contract must contain: "(1) an offer; (2) an acceptance in strict compliance with the terms of the offer; (3) a meeting of the minds; (4) each party's consent to the terms; and (5) execution and delivery of the contract with the intent that it be mutual and binding." Hubbard v. Shankle, 138 S.W.3d 474, 481 (Tex. App.- Ft. Worth 2004, pet. denied). "The determination of a meeting of the minds, and thus offer and acceptance, is based on the objective standard of what the parties said and how they acted, not on their subjective state of mind." Tex. Disposal Sys. Landfill, Inc. v. Waste Mgmt. Holdings, Inc., 219 S.W.3d 563, 589 (Tex. App.-Austin 2007, pet. filed) (citing Copeland v. Alsobrook, 3 S.W.3d 598, 604 (Tex. App.-San Antonio 1999, pet. denied)). Thus, the ultimate issue of "[w]hether a contract exists involves both questions of fact—such as the intent of the parties—and questions of law—such as whether, the facts as found constitute a contract." Zimmerman v. H.E. Butt Grocery Co., 932 F.2d 469, 471 (5th Cir. 1991).