DEBT COLLECTION ATTORNEY - INDIVIDUAL PROFILE

Donald D. DeGrasse

Donald D. ‘Don’ Degrasse is a debt collection lawyer based in Houston, Texas. In addition to creditor-debtor litigation (which involves large numbers of American Express debt suits), Degrasse lists Commercial Litigation and Real Estate as practice areas. He is a prolific litigator in the trial courts covering a broad array of civil cases, but is not very active in the courts of appeals.

Mr. Degrasse’s law degree is from Indiana University School of Law, where he completed his studies with a JD degree in 1979. He obtained his Texas bar license in 1981.

Attorney DeGrasse's Texas Bar Card Number is 05641800. In addition to the courts of the State of Texas, he is admitted to practice in the US Tax Court and in the U.S. District Court (and Bankruptcy Court) for the Southern District of Texas. Information available from the State Bar of Texas web site indicates that Attorney DeGrasse has no public disciplinary history.

PARTNERS / COLLEAGUES IN SAME FIRM: Robert L. Rolnick (name partner); Kevin T. McGuire

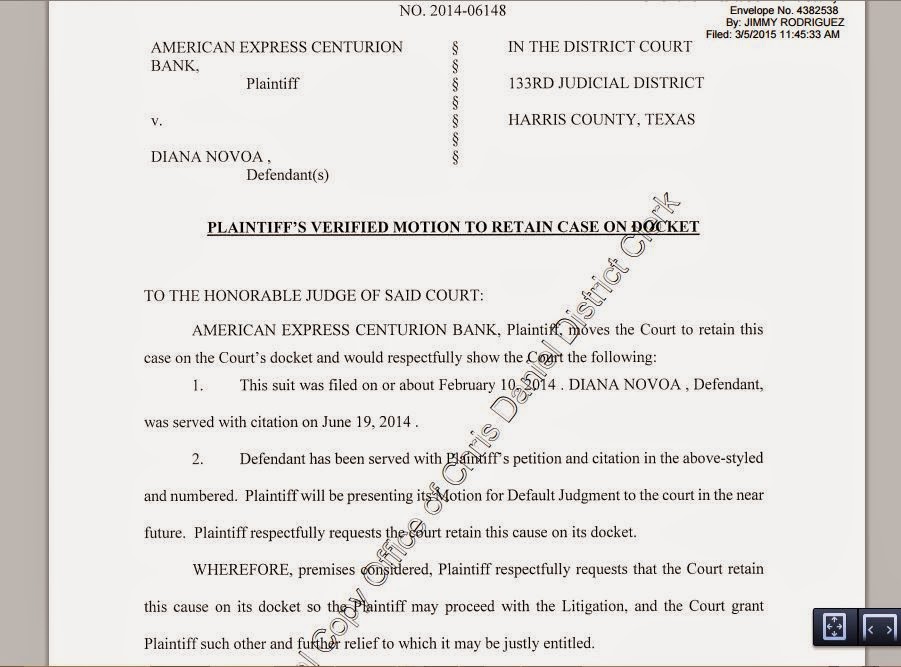

TYPICAL DEGRASSE PETITION IN A DEBT SUIT

CAUSES OF ACTION: BREACH OF WRITTEN CONTRACT AND ACCOUNT STATED

What does a typical DeGrasse petition in a debt suit contains (--> Sample DeGrasse Petition)

As causes of action in original creditor suits DeGrasse pleads Breach of Written Contract and Account Stated, each in a separate paragraph (IV and V, respectively).

DeGrasse's two theories are based on the same set of facts. Indeed, the section on "Account Stated" incorporates the allegations that precede it in full. It adds references to account statements sent by the original creditor, and alleges that there were never disputed by the defendant. DeGrasse seeks the same amount of damages on both theories. Unlike Anh Regent's pleading, DeGrasse's do not make any reference to acceleration of maturity of the revolving balance on the account, but characterize the pleaded-for amount of damages as "due and owing" on the account.

DISCOVERY WITHIN THE BODY OF THE PETITION

DeGrasse pleads discovery level 1. His petition template includes Requests for Disclosure and Request for Admission as numbered paragraphs, although the inclusion of the latter is not authorized by the rules of civil procedure, which specifically instruct litigants not to file discovery requests with the court. More on that topic below.

Although they contain discovery requests, DeGrasse's original petitions do not have a designated FACTS or FACTUAL BACKGROUND section separate and apart from the paragraphs devoted to the causes of actions; nor do they contain a CONCLUSION, or PRAYER section denominated as such. The untitled last paragraph lists the damages beings sought, including the amount of "the balance due, owing, and unpaid under the Agreement", court cost, post-judgment interest, and "any further relief to which the Plaintiff may show itself justly entitled." The prayer and list of damages does not include an express request for attorney's fees.

Requests for Admissions. DeGrasse's standard sets of "Requests for Admissions" comprise propositions sought to be admitted numbered with lower-case letters starting with a) through m) or w). There is more than one version of requests for admissions and they differ in length.

MOTIONS FOR SUMMARY JUDGMENT BY DEGRASSE

In Amex debt suits DeGrasse acknowledges that American Express is a Utah bank, and that Utah law is relevant to the case. He nevertheless moves for summary judgment under Texas law on causes of action for breach of contract and account stated, and does not expressly ask for judicial notice and application of Utah law. When the issue comes up in litigation, DeGrasse argues that Amex is entitled to judgment regardless of whether Texas law or Utah law applies.

DEGRASSE MOVES FOR SUMMARY JUDGMENT ON DEEMED ADMISSIONS

DeGrasse is one of those debt collection attorneys who inserts request for admission into his pleading so as to take advantage of deemed admissions should the defendant fail to answer them. The practice of embedding discovery requests into pleadings is not proper under the rule of civil procedure (which state that discovery shall not be filed), but is not uncommon either. Some debt collection attorneys do it routinely while others do not. Those that do, typically get away with it.

The proper method of serving discovery at the same time as the citation and original petition is to prepare two documents separately, obtain a citation referencing both documents; file the pleading only with the court; but have both the petition and the discovery requests served on the defendant with the citation. Allen L. Adkins, who set a high standard in debt collection litigation and also authored CLE materials, followed that practice as a matter of law firm policy. Few other do.

Injecting requests for admission into the initial pleading can confuse defendants because the deadline to answer the lawsuit differs from the deadline to answer discovery requests. Additionally, a defendant may be under the impression that the filing of a general denial will also deny the requested admissions, i.e. that it is enough to answer the lawsuit, only to be faced with a motion based on deemed admissions a few weeks later.

DeGrasse routinely files motions for summary judgment based, at least in part, on deemed admissions. Because he has the requests for admissions served as an integral component of the petition itself, he can rely on the return of service in the court's file not only as proof that the lawsuit papers were served on the defendant (for default judgment purposes) but as proof that requests for admissions were also served; and since the requests for admissions are part of the pleadings, their substance is also on file. The rules do not condone this stratagem, but it often works. Moreover, in a default scenario, no one is there to object in any event, and courts typically do not enforce pleading rules proactively.

RELATED TOPICS AND BLOG POSTS

Deemed admissions: Trap for the unwary

Disputing the existence of deemed admissions

Motion to strike or withdraw deemed admissions after failure to answer requests for admissions (RFAs)

DEGRASSE NAME SPELLING VARIANTS

This prolific Texas litigator has a compound surname. It is rendered as one word in his address block with the G in Grasse sometimes capitalized within the character string. On his signature, however, the De and the Grasse sometimes appear as separate words, and both are capitalized. Differences in the appearance of the signature on different documents suggests that Attorney DeGrasse (or someone on his behalf) actually signs in person, rather than using a signature stamp or e-signing with an image of his signature. DeGrasse's cover letters do not contain the name of a secretary, paralegal, or other clerical staff.

ADDRESS OF DONALD D. DeGRASSE of DeGRASSE & ROLNICK

Donald D. DeGrasse

DeGRASSE & ROLNICK

6363 Woodway, Suite 975

Houston, Texas 77057-1713

Tel.: (713) 840-9111

Fax: (713) 840-7263

Web address: www.degrasserolnick.com

-Zwicker-and-Associates-collection-firm.JPG)